Table of Contents

No matter how much we try to avoid the topic of cryptocurrency, the discussion is bound to happen again at some point. The fact is that digital assets are still very relevant to this day and are becoming a daily concern for some people. Many people in Japan, the most digital currency friendly country, have completely abandoned fiat currencies fully and are using Bitcoin as their primary one. But why do you need to know about this cryptocurrency? What kind of connections does it have to the traditional ways of making financial trades?

Let’s try to look at Bitcoin trading as if it was just another currency in the world. Just the same as you would trade for example a Forex currency pair, the same is done with Bitcoin. But there are some differences.

For example, it is very rare to find Bitcoin that is paired up with fiat currencies like the USD and EUR, but it doesn’t mean it’s impossible. Some of the largest crypto exchanges like Binance and Coinbase feature these pairings. However, it is impossible to do a BTC/ZAR pair at this moment.

Generally, the trading goes just the same way as you would expect, you buy Bitcoin with dollars and wait until the price increases so that you can sell. The exchanges usually charge commissions and not spreads, therefore you will need to make sure that the investment is worth it, as you may pay exactly the same amount in commissions as you make in profits.

Another good feature of Bitcoin is that it can be traded for virtually any other cryptocurrency, therefore many people just stock up on BTC and start trading other cryptos in the meantime. But how do you actually start trading Bitcoin?

At this point, it is hard to recommend Bitcoin to a complete beginner as it is very hard to make reasonable profits with it. As already mentioned you’d have to keep an eye on it every hour to make good decisions and for a beginner that could be too much to handle. But if you are still keen on investing in Bitcoin there are different ways you can start.

You can open an account with one of the large exchanges that I’ve mentioned above. The good thing about these exchanges is that they usually host some of the biggest cryptos out there right now. Like Bitcoin, Ethereum, Litecoin and etc. Trading Bitcoin on these platforms usually gives you the most value as they are the safest and the fastest. In most cases, a large crypto exchange will offer you a wallet as well, in order to keep your currencies safely stored. You can utilize this wallet as well as their trading platform as well. This option is very friendly to beginners in Bitcoin trade.

Option 2

Option 2You can go for 2 different Platforms when trading Bitcoin. For example, you can choose 1 company that is notorious for its secure wallets. You can open an account for that company’s wallet, buy the largest cryptos there and safely store them. After that, you can go to another crypto exchange, which is notorious for having smaller fees and commissions. Transfer your cryptos over from your wallet and start trading there.

The reason to why it is so complicated is simple. Some of the companies with the best wallets may not feature the crypto you want to buy or trade. For example, a low market cap coin is unlikely to be featured on a platform like Coinbase. You’d usually find them on Binance, actually, you can find pretty much any coin on Binance. Therefore you’d have to get a wallet on Coinbase, buy Bitcoin from them, store it in the wallet, transfer it on your Binance account and trade it with smaller cryptos. It’s hectic work, but quite rewarding once you get the swing of it.

The fact is that no matter how confusing Bitcoin can be, it was able to make a lot of people filthy rich. But why was it able to gain so much popularity? Especially last year? Well, most of the traders say that its primary value lies in the speed it can process transactions. The transaction segment of the financial world hasn’t been developing too much. Sure it was able to digitalize to some extent thanks to PayPal and other companies. But still, it takes a lot of time. Every time you need to withdraw or deposit some kind of money on a platform it may take days before the money arrives. Because of this, many people were getting very annoyed and saw the value and profit Bitcoin brought. Transactions with this digital currency can be made within a couple of hours, even minutes. For some cryptos like XRP, it can actually be done within seconds.

The value was the primary driver for the price in the distant past, but later it was replaced by hype when new traders saw the digital asset as a means to make money rather than use it for the convenience. At this moment it’s better to look at Bitcoin trading for profit rather than a means of making a transaction. As already mentioned it’s better to use XRP for the transactions because of the speed. However, the art of Bitcoin trading was what got a lot of young people involved in the financial world.

It’s quite similar to Forex actually, but it’s even more decentralized if you can imagine that. You have a couple of options. You can either:

This, in most cases, creates the feeling that you’re a lot more free with what you do to those assets, but it does indeed come with some disadvantages.

There are several reasons why you should avoid Bitcoin trading. Just like online Forex trading, it comes with advantages as well as disadvantages. Here I will list some of the most prominent reasons why people keep looking away from cryptos.

It’s no secret that cryptocurrencies have been involved in a bunch of controversies in the past, regarding securities. We’ve seen many companies get hacked and all of their cryptos stolen without a trace of the perpetrators. This became a very serious issue and a reason for people to avoid cryptos altogether. However, it had its own reasons. The crypto rush was so quick that companies often neglected the security aspect of their platforms, not putting in too much effort. As expected, Bitcoin trading platforms such as these, were quick to be attacked or abandoned completely.

Fraud

FraudLike any other financial industry, cryptocurrencies were a victim of some scams as well. Many opportunistic people saw the hype that was driving cryptos and managed to steal quite a substantial sum because of the trusting nature of beginner Bitcoin traders. The most recent one I can remember is Bitconnect, which promised over 100% returns annually on people’s investments. It all seemed legit from the beginning, they had a bunch of affiliate marketers, seemed quite transparent, help a lot of conferences as well. But in the end, it all boiled down to a scam when the founders just took all of the invested money and fled, never to be seen again.

The hacks that used to occur with crypto companies were actually very devastating because of this “scam culture”. Many people used to accuse these companies that they were lying about the hack, and were trying to run away with people’s invested money. In the world of Bitcoin Trading, this was not an empty accusation. As many companies had been caught red-handed trying to “cash grab” from when ICOs (Initial Coin Offerings) were all the hype, gather millions of dollars, then claim that they were hacked and disappear.

The only way to truly avoid these scams is to use the best platforms available. Platforms that have way too much exposure to hide anything. Companies like Binance, Coinbase and etc.

If you are somebody that has issues making tough decisions, then Bitcoin Trading is not for you. In most cases, you’d see people invest in Bitcoin for the short term as it is more likely to make a profit that way. The long-term investments have been dying out ever since the January slump, which is still going strong today.

By volatility, I mean that the price of Bitcoin can potentially change by $500 within hours in a single day. This means that you need to always be on guard. And always being on guard is very taxing on the mind and not everybody can handle the stress and pressure.

Generally, it’s best to start as soon as possible, but always look in what state the market is. At this point in time, the market is in its bear form. Meaning that the prices are either going steadily down or are struggling to make a breakthrough from a certain price point. For example, we saw a small bullish movement not too long ago when Bitcoin surged over $4,000, but it quickly came crashing down again.

In the past, the main factor which affected the cryptocurrency price was the hype. Unfortunately, however, the hype is now boiled down to a simmer and not too many people are feeling the bullish sentiment they used to this time last year. Cryptocurrencies are a very young market, hence the many Bitcoin trading beginners. This means that they are now in the process of switching over to the more relevant indicators for their prices.

For example, Bitcoin has pretty much moved over to the Supply & Demand module. Last year we saw people sell their Bitcoins in a massive panic, but it still remained relevant for a couple of days when the hype was keeping it up as people believed it would reach $100,000 by the end of 2018. Well, it’s 2019 and it can barely touch $4,000. After the selling became more frequent than buying, the prices plummeted to unseen levels. Honestly, we saw at least 50% gone within days. It was because of supply and demand, there were not enough people buying Bitcoin in order to maintain the balance of Supply and Demand. Supply outpaced Demand and the price naturally fell. This was easy to see for people well versed in economics, but those who couldn’t spot the trend suffered terrible losses. At this point, I’d say that it’s still reasonable to do Bitcoin Trading for profit. While the price is somewhere between $3,500 and $4,000 it’s okay to buy. But the moment it goes further than $4,000 it’s time to sell as it will be hard to maintain the sentiment.

The fact that cryptocurrencies were becoming very popular couldn’t be ignored by some of the Forex brokers. They needed to somehow accommodate all of the traders looking for secure platforms to do crypto trading. Since the brokers didn’t really want to invest too much in buying these cryptos to create a platform. A compromise was made with CFDs. Nowadays you can find crypto CFDs being traded on pretty much every trustworthy Forex brokers’ platform. But what’s the difference between Bitcoin CFD trading, and Bitcoin Trading as a whole? Well, there’s several.

The advantages of trading Bitcoin CFDs

The advantages of trading Bitcoin CFDsThe first advantage I’d like to talk about is the security you get with some of the brokers when trading the CFDs. For example, a well-established Forex broker can give you a lot of protection for your assets if you trade on their platform. Comparing this to the always susceptible crypto exchanges, it’s worth it to pay a bit more in commissions.

Another addition to security is the regulation that these brokers have. It keeps them in check with the local government. The crypto exchanges usually go unlicensed as cryptos are still being discussed as an asset they could be referred to as, thus leading to a lack of a regulatory body for them.

The second advantage is, of course, the leverage you can get with crypto CFDs. When buying the actual crypto, you can only use the funds you have. But when buying the contract for a crypto price, you can utilize the broker’s leverage and increase your investment tenfold or sometimes even a hundredfold. This can potentially skyrocket your profits, but could also lead to terrible losses as well.

The biggest disadvantage you will find in this option is the fact that you don’t actually own the cryptocurrency. You just have the contract about the price. Although many traders claim that they don’t need crypto, to begin with so this feature is not a minus for them. But I believe that it’s best to own what you pay for, as it gives you more freedom.

The reason why it’s best to actually own the crypto you invest in is the fact that you gain a lot more mobility. By mobility I mean, you can relocate these cryptos a lot more easily. You can use them to buy various items and services online, while Bitcoin CFD trading will only get you to return at a specific time, which restricts their utility.

You can’t control when the position will be closed with CFDs. This means that when you enter the contract it will have an expiry date. So if you bought it when BTC was at $3,000 and you were hoping it would go up to $4,000. You may find it very disappointing when you see that it’s about to expire and BTC is sitting only at $3,200. This forces you to buy again and hope for the best. If you owned Bitcoin in the beginning, you could just lay back and wait.

Also, the commission on maintaining these positions can quickly rack up in price as most brokers charge a fee for holding that position over-night. Judging by this, it is very risky to engage in a long-term Bitcoin CFD investment if you’re not completely sure that the price will skyrocket. In addition, many brokers charge you tax on your profits from Bitcoin CFD trading.

So, in conclusion, I’d say that the leverage is the only reason why Bitcoin CFD trading is superior, in pretty much any other case, just outright buying them is better.

Bitcoin shouldn’t be anything new to us at this point, it has become so engraved in our society in the 21st century, that we cannot afford to ignore it anymore. But many of us still cannot comprehend, what Bitcoin actually is. As a matter of fact, some still believe they’re those custom made coins you see on some stock images on various articles. Here is a very basic explanation for the beginner Bitcoin traders out there.

Bitcoin is the world’s first digital currency. 10 years ago when it was first made, it was thought to revolutionize the transaction systems of the world. The people who got most interested in the digital asset were very concerned about having to use the services of banks when making transactions. Bitcoin was going to change that as it would be a completely peer-to-peer transaction system. You might say “Well, there still were online transactions, weren’t they peer to peer?”. Well, technically yes there was peer-to-peer but they still utilized a separate company or bank that needed to be the middleman. With Bitcoin, the users would get a specific hardware wallet or online wallet. Something that nobody had access to but themselves and store their assets there.

By having this anonymous wallet, the bank wouldn’t be able to interfere in the transactions. Which means, no transaction fees, no delays and especially no recordings of your transaction history. Personal information is becoming harder to hide in this day and age, Bitcoin was supposed to be the ultimate salvation for the people with trust issues.

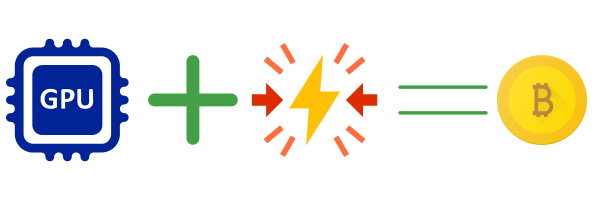

Well, the fact is that there is no unlimited supply of Bitcoin in the world. There’s about 17.5 million in the market. Judging by the fact that there are already millions of people chasing it, it is obvious how expensive it has gotten. But how are you able to “generate” these Bitcoins? How were the first people able to acquire them?

Well, you’ve probably heard about mining right? What Bitcoin mining means is that you, connect your hardware to a Blockchain. After being connected the hardware helps create other blocks, which then contain some information about transactions, all of which is encrypted. In order to access the block and authorize the transaction, the block needs to solve a very hard mathematical problem, something that takes a lot of computing power. If you are able to provide that computing power for the block to solve that problem, you are then rewarded with the coin. That’s why you see the mining farms, consist of nothing more than strong GPUs in freezing temperatures and a lot of wires. Mining used to be quite profitable back when Bitcoin trading was on the rise. Even on your own PC, you were able to mine about 100 in a very small amount of time. But at this point, it takes way more computing power and electricity to make it profitable.

The fact remains the same. Bitcoin prices are going down, or they just cannot surpass the $4,000 mark. Because of this, it will be unfair for me to recommend that you make a long-term investment in Bitcoin. Therefore I would advise Bitcoin CFD trading at the moment. Yes I know, I discredited them above, but at this point, a short-term contract isn’t too risky and is way more profitable than it was a year ago. Therefore with all of the additional security, it may actually be a good gateway for a beginner to start Trading Bitcoin. You can find some of the Best brokers that offer crypto CFDs on our website.