XM broker reviews, interface, and trading tools provided

XM is one of the largest Forex brokerages, It is also one of the older ones as well, but this doesn’t mean that they are not up to date with all of the tech innovations in the financial sphere. The company was created in 2009 in Limassol, Cyprus. We’re also happy to report that the company is regulated and licensed by CySEC, the local financial watchdog. Besides this one regulation, XM Forex broker also complies with the rules of the regulators such as the FCA, BaFIN, AFM, CNMV, FI, FIN.

As we delve into XM forex broker review, let’s get the question out of the way from the very beginning. Is XM legit? Yes, they are indeed. Is there at least a small possibility of an XM scam? No, definitely not. By being compliant with so many financial regulators, it would have had so many more fines to pay compared to the profit it would ever be hoping to make as a scam. If anything, XM is the opposite of a scam. Let’s jump right into their features and options, to find out what truly sets them apart from the rest.

First impressions and Regulations

As already stated, in terms of regulation XM is probably the one that is compliant with the most, if not all, financial regulatory rules. This XM review could have taken a completely different route if we couldn’t find them with the regulators. But checking up on them, all of the searches came back positive, they are indeed registered everywhere.

XM is an international company that has customers all over the globe and is regulated by a large number of regulatory companies, which is what allows it to work with traders anywhere in the world. So the question of whether XM fraud is out of the question.

Is XM regulated in South Africa?

Some of you might ask though, is XM South Africa regulated by the FSCA? This is where the problem arises – it is not, at least as of writing this article. This is because XM’s global presence has yet to be officially announced in South Africa, even if they do offer their services to traders from here.

Though do not worry, the amount of regulation and the track record XM has with the global community guarantees that it is going to be as honest in its dealings with South African traders as with any other trader in the world. Also, we have reached out to XM Forex broker representative and we were told that the company is in process of getting FSCA regulation, it simply takes a while for the local regulator to approve the application.

XM.com review of the website

Our first impression with their website was also a very positive one, as they displayed a nice layout of information. Something we always approve of brokers doing as it makes our job so much easier. The registration part was as easy as you’d find anywhere else, and we also found the choices with the preferred language varied a lot as well. There were more than 20 options, which is always a welcome sight to see and a boost to reliability.

XM FX brokerage features

Now let’s see what the trading conditions with this broker are. After these amazing first impressions, we need to discuss whether or not they align with the services they bring to the table. All of the major important features, such as spreads, leverage, and fees will be discussed here.

Spread

Spread

We’re happy to report that XM has some of the lowest spreads available on the market right now. The lowest we were able to see and experience was 0.1 pip for Forex major currency pairs. The fact that they have spreads indicates that they don’t have any type of commissions which is always welcome news for a trader. The addition of having tight spreads is also encouraging to go ahead and start trading with the brokerage. Speaking of starting…

XM Minimum Deposit

XM Minimum Deposit

When you decide to start trading with XM, you’ll be met with a choice of accounts. In most cases, Forex brokers would have 3 types. A beginner, a medium and a VIP account. With XM you get those 3 choices too. The lowest minimum deposit is 70 ZAR with the XM Micro account, but it looks like the XM Ultra Low account is the most popular at 700 ZAR as a minimum deposit. Many people believe that when a broker has such low minimum deposit requirements it’s almost always a scam. Is it the case here? Can XM be trusted? Yes, they can be trusted. Being one of the largest Forex Brokerages in scale, their margins have gone to a point where they are able to afford such low minimum deposits. Plus, despite the low deposit requirements they are also able to offer leverage through the roof, as well as some nice bonuses on the side.

XM Maximum Leverage

XM Maximum Leverage

At this moment the leverage cap is at 1:888. This may be quite surprising to some of you who are familiar with ESMA. How can they have such big leverage if they are regulated in the EU? Well, remember when we said that they are not regulated in South Africa? That’s why they are able to offer this leverage, they have nothing stopping them from offering such high leverage.

But before you start jumping at the sight of this leverage and start throwing your money around, please keep in mind that you should know what you’re doing. Going into a trade with 1:888 leverage, can have incredible profit for you, but if you are a beginner and have no idea what you are doing, it will be devastating for your capital and to your life in general.

XM Withdrawals

XM Withdrawals

After you’ve managed to gather up a nice chunk of profit on your account you will want to start considering withdrawing the funds to use in real life. However many brokers always require that you pay a withdrawal fee, which can really rain down on your hard-earned money withdrawal parade. The broker claims that they have 0 fees on any type of XM withdrawal.

This is an amazing opportunity for people who trade large amounts. The more you trade the more profit you’re bound to make, therefore the more you’re eligible to withdraw. Having to pay fees in those cases can be devastating. In terms of withdrawals with XM, you can opt for pretty much everything. Electronic payments, WIRE transfer, Credit/Debit card transfers as well.

Trading platforms

Trading platforms

XM Forex broker really likes retro by the looks of it. You’ll only be able to use their services with MT4 or MT5. This at a first glance does indeed seem a bit odd, as there’s not too much variety with the platforms. We’d prefer to see some newer and better software to be featured with the broker. For example, cTrader would have been a great addition to their arsenal. As well as a Web Trader, which they could easily develop themselves. However, MT4 and MT5 are still quite viable, and the malleability and how easily they can be customized to your needs make them the perfect trading platforms if you have a certain set of requirements and visions you would like to add to your platform.

Account Types

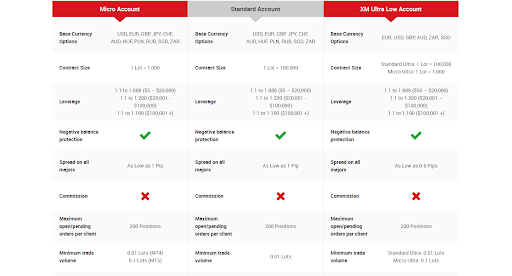

XM offers you a set of three accounts dedicating fully to real-time trading, as well as a fourth account type which will allow you to get used to the platform and trade imaginary money, shielding you from the danger of spending it all in a single sitting. All four of these variations have their advantages and disadvantages, but can be definitely useful in their own ways for a certain type of trader. The account types offered are:

- Micro Account – This account type offers to trade in most of the popular currencies, a nice leverage range (1:1;1:100; 1:200; 1:888) but it also limits your lots to 1000. The spread is as low as 0.1 pip. It allows you to open 200 positions and gives you a trade size restriction on MT5. Otherwise, it provides you with all the bonuses of the standard account, as well as an Islamic alternative of the platform.

- Standard Account – The standard account is in many ways similar to the Micro account, but does not limit the number of your lots in 1000, instead of allowing you to have 100000 lots, which is a significant increase in your trading volume availability. The account type also does not limit your MT5 lot size. It also keeps the lot restriction per ticket down at 50.

- XM Ultra Low Account – This type of account lowers the pip to 0.6 and takes away the trading bonuses you had. The minimum deposit is increased to 730 ZAR, unlike the other two types of accounts. The account type also introduces some variability between Micro standard and Micro ultra, limiting the trading volume and contact size according to which one you choose.

XM also offers a demo account, as mentioned above. Such an offer is a godsend to all beginners. You see, as a beginner, who is just starting to trade and learning about Forex, you might not want to invest real money into the market. So demo accounts such as this are a great tool to start working on the platform and the trader that interests you the most. Really nice of XM to include this as one of their offers.

Live chat and other support

Live chat and other support

One of the most important things in the Forex industry is the speed of response. As things on the market change really fast, you need to react equally quickly. What is even more important though is that you be able to react quickly in case something goes wrong with your platform. The Forex broker needs to be able to do the same thing. Thankfully the live chat support service offered by XM Forex broker works really well, giving you answers almost instantly, as you get in touch with them. The same goes for the other types of support systems. Email works well, even though it is slower than that live chat system. This type of dedication and support is something you won’t see with the average broker, which is why this is adding points to the already high XM rating.

Can XM be trusted?

Based on this XM broker review, our expert staff says yes, XM can be trusted. Not only that but we also believe that they are one of the few Forex brokers in the world that should be trusted. They are highly regulated, incredibly well supported and their offers are both realistic and malleable. The XM reviews available online are also very positive. Something not a lot of brokers can offer.

Comments (0 comment(s))