TradeToro review

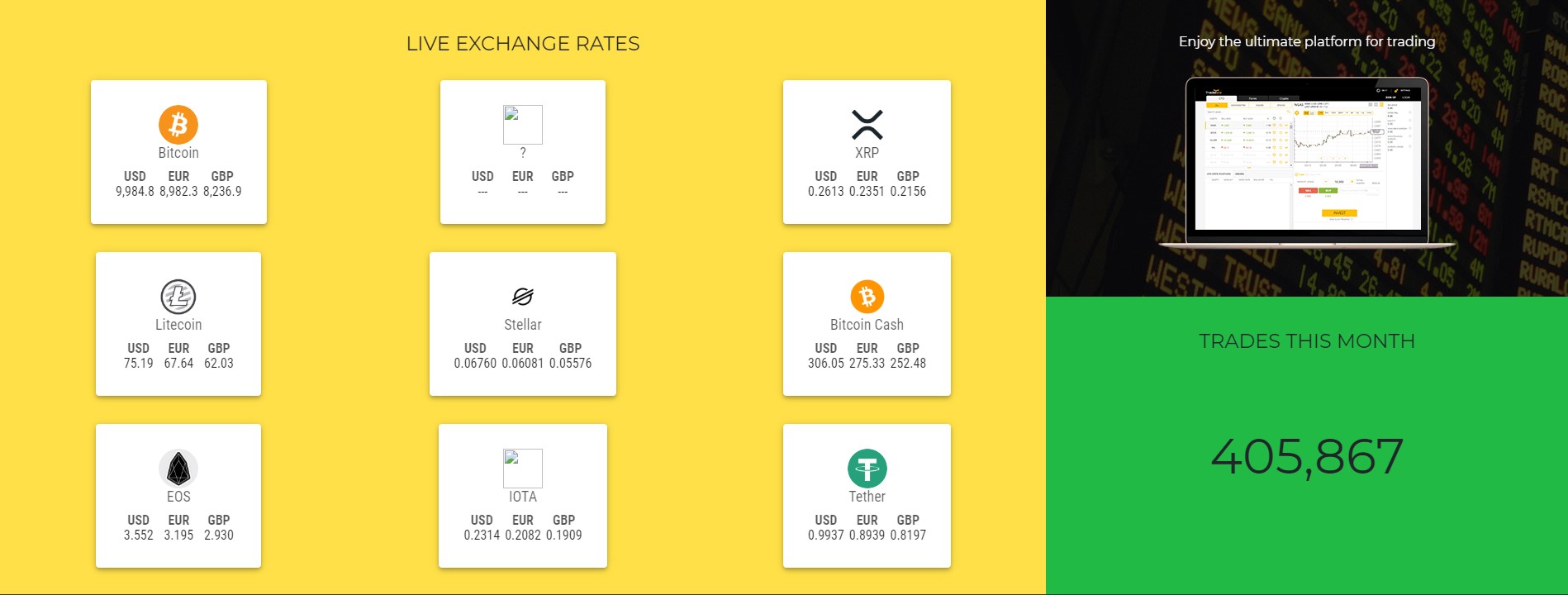

TradeToro was once considered to be an anomaly in the financial markets as they base their whole business model on CFDs on cryptocurrencies and nothing else.

This choice of assets was what led to hundreds of reviewers claiming the TradeToro scam as cryptocurrencies were always associated with fraudulent companies in 2018 due to 80% of new projects stealing people’s money.

It’s unknown how TradeToro managed to push through the market prejudice but they are still operational to this date. With a license from an offshore jurisdiction, it just begs to be classified as a scam, which we will be trying to determine in our review.

In this TradeToro review we will be focusing on the company’s legitimacy, the legality of operating in South Africa and the trading conditions they offer to their traders.

TradeToro review – the legal documentation

TradeToro is owned and operated by Ivory Group limited, a licensed and registered company in the Marshall Islands. Although this classifies as an offshore jurisdiction, people are still willing to look it over based on the fact that operating a CFD Brokerage in the EU is completely redundant.

Due to serious restrictions from the European Securities and Markets Authority, CFD Brokers have very little to offer their traders that would beat offerings from Forex brokerages and stock brokerages. The leverage is always limited to 1:30 on Forex pairs and 1:2 on cryptocurrencies, therefore traders might as well go with companies that specialize in them.

However, having an offshore license does not guarantee CFD Brokers unhindered access to the South African market and TradeToro is no exception. We can definitively say that they are operating in our market illegally and therefore should be avoided. The first confirmation we got about the TradeToro fraud was when they promised services to all jurisdictions especially those that aren’t regulated.

Although most scammers don’t disclose that they’re operating from offshore jurisdictions, it still doesn’t excuse TradeToro’s location.

TradeToro trading conditions

In terms of trading conditions, TradeToro is no match for actually cryptocurrency exchanges or locally licensed CFD Brokerages in terms of both leverages, minimum deposits, and spreads.

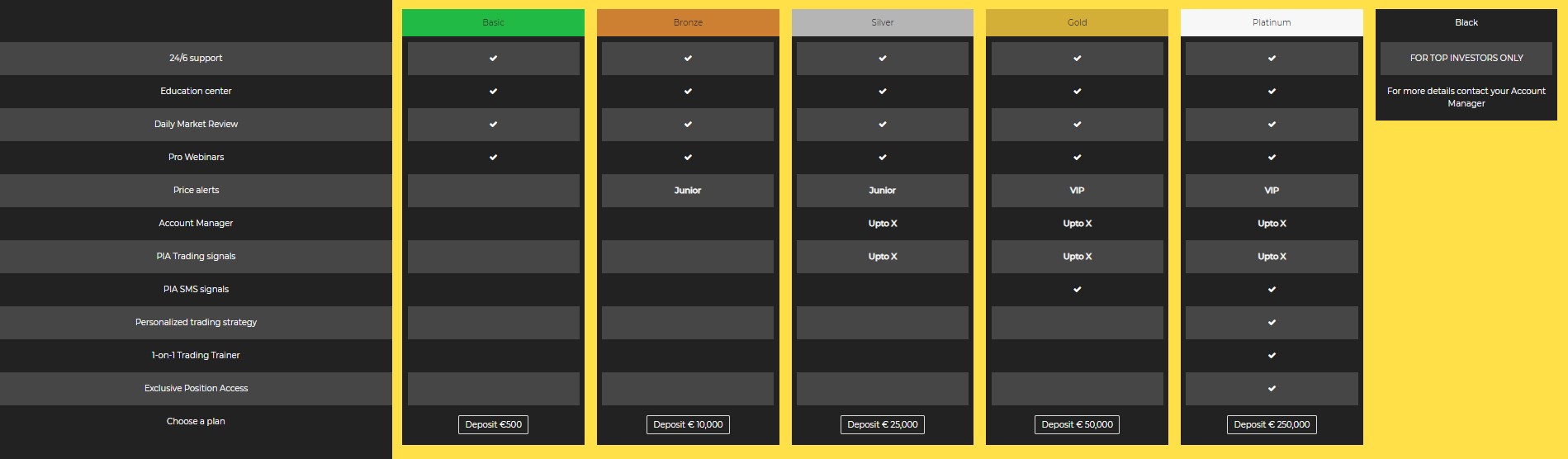

Traders will be met with a gateway of $500 as a minimum deposit, and maximum leverage of 1:20 on every cryptocurrency. Crypto exchanges have long since passed the 1:20 leverage cap and are now offering as much as 1:100 for their traders, plus the ownership of their assets.

TradeToro can’t even come close to them in terms of value. All of this begs the question “Is TradeToro legit?” So far we’re going to have to go with no on this one, but let’s take a look at the withdrawals just to confirm our suspicions.

TradeToro withdrawals

TradeToro provides a large variety of withdrawal methods but promotes Wire transfer as the most reliable one. The fee here is $30 which would be quite crippling for small-time traders. On other methods, there are no fees which are at least some good news.

Can TradeToro be trusted?

After so many red flags right after one another, it’s very hard to call TradeToro trustworthy. Even if they’re not a scam, they’re not worth it for the $500 price tag just to getting an account. The shady nature just brings down the whole value of the company into the ground.

Comments (0 comment(s))