Axiory Review – Discover 80+ Instruments with Top Conditions

Based in Belize in 2012, Axiory is one of the more respected Forex trading brokers that not only features a sturdy license but is also lucrative to trade with. It features multiple financial instruments that you can trade online, including currency pairs, CFD indices, energies, and metals.

Axiory’s regulation comes from the International Financial Services Commission (IFSC) of Belize, which is one of the most popular Forex regulators on the market. And besides the regulatory oversight, the IFSC also obligates Axiory to provide you with a bunch of money protection mechanisms, be it negative balance protection or fund compensation.

But what about lucrativeness? Well, Axiory’s commission levels are pretty low with 0.2 pips for EUR/USD spreads, while the maximum leverage goes up to 1:777, allowing you to boost your trading equity by x777. And what’s more, fast market execution speeds help you catch the most profitable moment in the market.

In the following review of Axiory Forex broker, we’re going to take you through all of the most important features, as well as seemingly non-essential ones, that you need to know about this broker. Ultimately, it will help you make up your own mind whether to choose Axiory as your trading partner or not.

Is Axiory legit? – The regulation overview

The first and most important aspect of a Forex broker review is regulation. If you’re pondering whether your broker is safe to trade with, you can just check out its license and try to find out how credible that license is. More often than not, you’re going to see a bunch of online resources reviewing different pieces of regulatory materials.

In the case of Axiory, we found out that the company was founded back in 2012 in No.1 Corner of Hutson Street and Marine Parade, Belize City, Belize, and received the financial license from the country’s International Financial Services Commission (IFSC), which strengthened our Axiory opinion quite a bit.

You see, the IFSC license is a pretty popular Forex license that many brokers have. It ensures that the brokers adhere to strict financial guidelines. In addition to that, Axiory is also a member of the Financial Commission, which is an international organization that brings a bunch of brokers together to pursue one universal goal: make the Forex trading experience as safe as it can get.

How is your money protected at Axiory?

One of the main achievements of the IFSC + Financial Commission combination is that Axiory offers you a number of complex fund protection mechanisms. All of these work in combination to protect you from sudden financial crises.

These measures include:

- Account segregation – Ensuring that your funds are stored on separate bank accounts and the broker cannot access them for its own use.

- Negative balance protection – Ensuring that when using leveraged positions, your account doesn’t go below zero to force you to make additional payments for inflicted losses.

- Fund insurance – Ensuring that if Axiory goes bankrupt or something similar happens to the company, you’ll still be compensated from the compensation fund.

As our Axiory review manages to convince us, the broker definitely cares about the safety of its clients, as well as their profitability, which we’ll discover more deeply in the upcoming sections of this review.

Axiory’s trading assets

Besides regulation, the second-most important characteristic of any broker is its financial instruments. If your broker offers a number of different asset classes, instead of concentrating on Forex products only, you can diversify your portfolio against sudden and damaging market fluctuations.

That’s certainly the case with Axiory. As a primarily Forex trading brokerage, it features dozens of currency pairs on its website, however, there are more instruments than just currencies. In total, there are 4 different asset types, including:

- Currency pairs

- CFD indices

- Energies

- Metals

Currencies

When trading Forex with Axiory, you’re allowed to choose from more than 60 currency pairs, be it the EUR/USD, GBP/AUD, or CHF/JPY. As discovered during our Axiory broker review, the broker features all three currency types – majors, minors, and exotics. This means that you can choose completely non-correlated currency pairs and reduce the risks of loss due to high volatility rates.

When choosing Axiory as your service provider, not only are you getting a diverse instrument base but also great trading terms and conditions. For instance, the minimum spread for the EUR/USD pair can go as low as 0.2 pips for the Nano account, which means you can practically trade this pair without spread markups (although you need to pay the commission for a Nano account). As for the maximum leverage, you can increase your initial capital by as much as 1:777, which is a mind-boggling feature.

CFD indices

In addition to currencies, you can also trade many other financial instruments, and CFD indices are definitely among them. While doing the Axiory Forex broker review, we found 10 different index contracts that you can trade with a minimum of 0.7 spreads. These include NASDAQ, Dow Jones, and many other indices.

Energies

When it comes to commodities, Axiory offers 5 different energy resources that you can trade with equally beneficial terms and conditions. For instance, you can use leverage to increase your capital reach, while the 0.5 minimum spread leaves a huge chunk of your profits onto your account balance. As for the instruments themselves, Axiory allows you to trade crude oil and natural gas with numerous variations.

Metals

Another commodity type you can trade with Axiory is metals. And currently, there are four basic metal commodities to choose from: Gold, Silver, Platinum, and Palladium.

The minimum spread for these assets goes as low as 1.6 pips. As for leverage, Gold and Silver trades can be increased by 1:100, whereas the Platinum and Palladium positions can use a 1:20 leverage ratio at max.

How affordable are Axiory’s commissions

The next entry in our Axiory review is its commission levels. Being able to maintain the majority of your generated profits is no less important than being able to generate them in the first place. If the broker has affordable commission rates, you’re going to have a more lucrative experience trading with it.

With Axiory, we came across a typical set of commission charges, although we also found that some common commission types were outright removed from the platform. In this section, we’ll cover both trading and non-trading fees.

Trading fees

When it comes to trading-related fees, the primary commission type that you’re going to have to pay is spreads. A spread is a price difference between the bid and ask prices and it’s the most popular fee charged by Forex brokers.

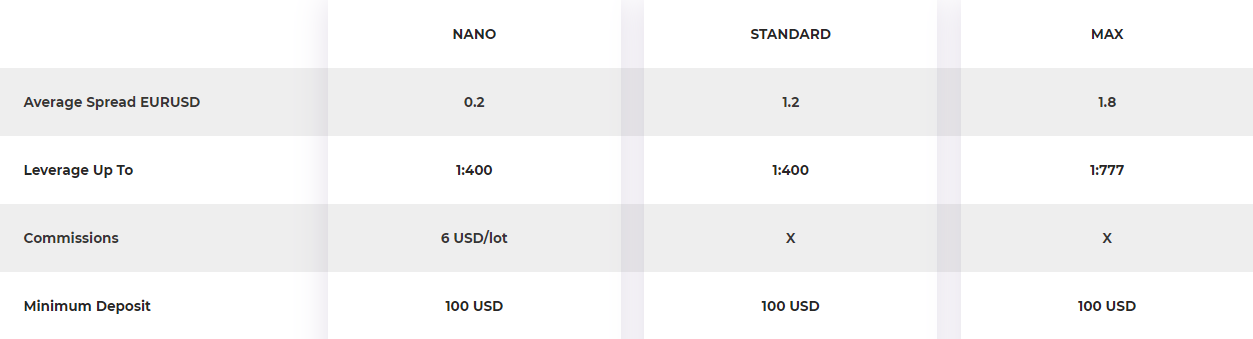

With Axiory, you’re charged with a very affordable spread commission rate. For the Nano account, you only need to pay the minimum spread of 0.2 pips for the EUR/USD pair, which takes our Axiory opinion to the new heights. This level of affordability can be seen across all account types: the Standard account will charge you 1.2 pips and the Max account – 1.8 pips.

Another trade-related commission type that you’ll need to pay is the account fee. But it’s only present for the Nano account, and it’s only going to set you back by a mere 6 USD per one lot (100,000 currency units). Other than that, there will be no other account fees and not even instrument-related commissions, which is a huge advantage for Axiory.

Additionally, there’s also a rollover fee, i.e. swaps, that you’ll be charged with if you decide to keep your trades open from one day to another. This is a very common commission type that the majority of brokers impose and it’s not going to be something that will take a huge chunk of your earnings away from you.

Non-trading fees

When it comes to non-trading fees, our review of Axiory Forex broker shows that pretty much all charges are removed from the platform.

For example, when you’re making deposits and withdrawals with your Axiory account, the majority of financial platforms will have no fees whatsoever. And a number of methods that come with commissions behave so only because the provider is charging its service fees, not Axiory.

What’s more, even one of the most regular non-trading fee, inactivity fee, is eliminated from the platform. What that means is that no matter how long you leave your live account untouched, Axiory won’t charge you a penny for not using it.

Bonuses and other promotions at Axiory

Moving on, let’s take a look at yet another popular trading offering: bonuses. There are many brokers that include bonus promotions to their platforms to attract as many customers as possible. But while reviewing Axiory’s platform, we didn’t fund anything remotely similar to bonuses.

So, is Axiory legit? Based on our experience with Forex brokers, a broker that doesn’t offer bonuses – these eye-catching promotions – is more likely to focus on more substantial trading terms and conditions and try to improve its platform with more important features like licensing, commissions, and leverage ratios.

Therefore, Axiory is definitely a legit and trustworthy Forex broker that wants to increase your profitability in the market with substantial trading terms and conditions.

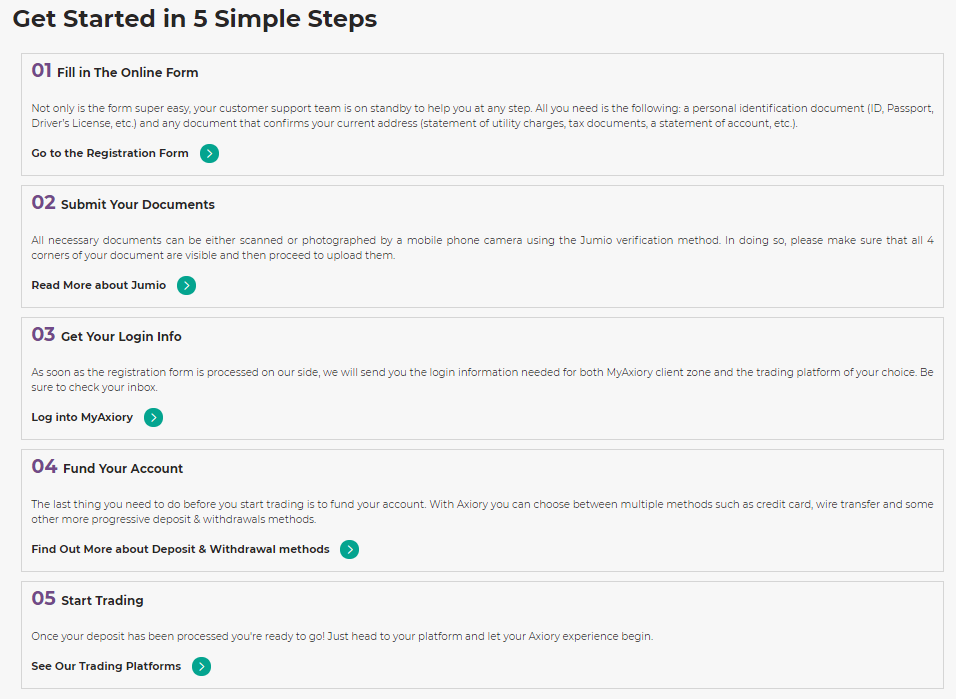

How to sign up at Axiory?

The account registration process is one of the first interactions between you and your Forex broker. If the process is simple and quick while also feeling legitimate, the broker increases its chances of acquiring a loyal client.

In the case of Axiory, that’s certainly the case. While conducting our Axiory Forex broker review, we personally created a live trading account, which surprisingly wasn’t long or burdensome; with just a few steps, our account was already good to go.

Interested in what steps we took exactly? Here they are:

- We submitted the application with just the most basic information

- We uploaded identity and residence verification documents

- We logged into our MyAxiory space with the received log-in details

- We funded our account

- We began trading

With these steps completed, you too will be able to start trading all available financial instruments at Axiory.

As for what specific information you’re required to provide, Axiory only asks for the most basic details, such as your full name, date of birth, residence, employment details, and bank account number. And when it comes to documentation, you’re required to upload two types of documents. For identity verification, you need to upload either of these documents:

- National ID

- Driver’s license

- Passport

For residence verification, the required documentation found during our Axiory broker review is as follows:

- Utility bill receipt

- Telephone bill receipt

- Commercial bank or credit card company bills

- Residence permit

These documents are requested under the KYC framework, which verifies that you’re the real person and you are actually trying to start trading with Axiory.

Available trading platforms at Axiory

In a financial trading market, the entire logistical aspect of exchanging currencies, stocks, commodities, and a bunch of other assets is entirely dependent on trading software. If the software is capable of accommodating a decent number of tradable instruments and is packing very useful tools and features, you can have very profitable trading experience.

Axiory’s trading platforms are just what you’d expect from a trustworthy Forex broker. It offers you two of the most popular and sophisticated pieces of software: MetaTrader 4 and cTrader. And as our Axiory review shows, these platforms are jam-packed with useful features:

MetaTrader 4:

- Trading Instruments: Forex, CFD indices, Energies, Metals

- Technical Indicators and Other Objects: 50+

- Execution Method: Market

- Automatic Trading: Y

- Copy/Social Trading: N

- Downloadable: Y

- WebTrader: Y

- Mobile Trader: Y

cTrader:

- Trading Instruments: Forex, CFD indices, Energies, Metals

- Technical Indicators and Other Objects: 50+

- Execution Method: Market

- Automatic Trading: Y

- Copy/Social Trading: Y

- Downloadable: Y

- WebTrader: Y

- Mobile Trader: Y

Let’s take a closer look at each of these platforms and see how you can maximize their potential.

MetaTrader 4

Released by MetaQuotes back in 2015, MetaTrader 4 is by far the most popular and widely-used Forex trading platform in the world. Back in the time when it was released, it introduced some of the most fundamental changes to the way people traded currencies, which is why it has remained a top platform to use in Forex.

And Axiory manages to leverage MT4’s advantages for its platform. While reviewing Axiory MT4, we found that the software packs more than 50 technical and fundamental indicators, which are extremely useful for predicting future price movements. Moreover, Axiory also supports automated trading with Expert Advisors, market execution with lightning-speeds, and a 99.99% success rate when executing trades.

cTrader

cTrader is relatively younger than MetaTrader 4; it was released in 2010 by Spotware. But even a decade of continuous operation was enough for cTrader to establish its place as a sophisticated trading platform.

With Axiory’s version of cTrader, you can get a bunch of advantages that will take your trading game to the next level. For instance, the platform features over 60 technical indicators, as well as automated trading cBots, social trading, and many more.

Trade with Axiory on the go

In today’s quickly-growing smartphone world, Axiory has realized that more and more people are turning to their mobile devices to trade all sorts of financial instruments. With that said, our review of Axiory Forex broker showed us that there’s also a mobile trading platform available for you. Whether you’re using an Apple iPhone or an Android device, you can simply download either MetaTrader 4 or cTrader mobile and start trading with Axiory.

Axiory’s execution policy

As noted earlier, Axiory’s trading platforms are packing quite impressive trading features that ultimately help you increase your profitability in the market. And one of the main reasons why that is the case is Axiory’s top-notch execution policy.

Under this execution policy, you can place your orders at incredible speeds and virtually the same market prices without slippage, which is a huge advantage. Being able to do that allows you to maximize your profit potentials.

Under the same market execution policy, Axiory also sets itself apart from other brokers by declining to engage in requotes – a nasty policy of placing opposite trades of the clients. So, can Axiory be trusted? Based on this fact, it most certainly can.

And when it comes to order types, Axiory lets you place all of the most popular order types that help to safeguard your positions from various risks. For example, if you place a take-profit order, the trade will close the moment the price reaches your desired point. Therefore, you’ll have more chances of securing profits.

Available account types

As we have noted earlier, creating a trading account at Axiory is pretty simple and doesn’t take much of your time. By provide the broker with just a few basic details, you’re going to be able to start trading right away.

But which account types can you get? Well, under the live trading accounts, we were able to find three different packages: Nano, Standard, and Max. Additionally, our Axiory review also shows that there’s a separate Islamic account for Muslim traders, while beginners can take full advantage of a demo account.

Here are the specific features found within Axiory’s live accounts:

Nano Account:

- Deposit Requirement: 100 USD

- Max. Leverage: 1:400

- Minimum Spread on EUR/USD: 0.2 pips

- Commissions: 6 USD/lot

- Available Products: Forex, CFD indices, Energies, Metals

- Maximum Simultaneous Positions: Unlimited

- Trading Software: MetaTrader 4, cTrader

- Maximum Order Size: 1,000 lots

Standard Account:

- Deposit Requirement: 100 USD

- Max. Leverage: 1:400

- Minimum Spread on EUR/USD: 1.2 pips

- Commissions: N/A

- Available Products: Forex, CFD indices, Energies, Metals

- Maximum Simultaneous Positions: Unlimited

- Trading Software: MetaTrader 4, cTrader

- Maximum Order Size: 1,000 lots

Max Account:

- Deposit Requirement: 100 USD

- Max. Leverage: 1:777

- Minimum Spread on EUR/USD: 1.8 pips

- Commissions: N/A

- Available Products: Forex, CFD indices, Energies, Metals

- Maximum Simultaneous Positions: Unlimited

- Trading Software: MetaTrader 4, cTrader

- Maximum Order Size: 1,000 lots

Islamic Account

As we have noted previously in our Axiory Forex broker review, there are more account types than just these three live accounts. And one of those is an Islamic account. You see, when you trade currencies on a margin and decide to leave your position open for more than a single day, there’s going to be an interest rate differential between the two currencies in a pair, and depending on which currency has a higher interest rate, you’ll either have to pay or be credited a rollover fee – a swap.

In Muslim countries, however, the interest rate on any product or service is strictly prohibited. Therefore, hypothetically speaking, a Muslim trader wouldn’t be able to engage in overnight currency trading.

But with Axiory’s Islamic account, it’s still possible for Muslims to do long-term trading without violating their faith. And they can do that by using that Islamic account, which eliminates all interest rates on currencies. And, what’s more, you can open this account for any live account, be it Nano, Standard, or Max.

Demo Account

And last, but certainly not least, we also found a demo trading platform during our Axiory broker review. This is a particularly advantageous offering for beginner traders who want to hone their skills without financial risks. What’s more, Axiory gives you a 10,000 USD virtual budget that automatically refills when you run out of it.

So, one thing to be said about Axiory’s trading accounts is that you can choose from a very diverse account base with lucrative trading terms and conditions – something in which Axiory can easily take pride.

Which countries are supported by Axiory?

One additional detail to mention here is that Axiory has a vast coverage area across the globe. To put it vaguely, all continents are supported by the broker’s services, which means you can trade Forex, indices, and commodities pretty much everywhere.

Having said that, however, there are still some geographical restrictions that we came across during our review of Axiory Forex broker. The countries like Albania and Pakistan, along with some more, have specific restrictions on Axiory’s products and services, whereas the countries listed below are entirely removed from the coverage base:

- The United States

- Canada

- EU countries

- The Islamic Republic of Iran

- Indonesia

- North Korea

- Belize

To Axiory’s credit, however, the reason why these countries wouldn’t be supported lies more within themselves and not within Axiory: some of the countries have very strict regulatory frameworks that restrict most brokers to provide their services to these countries, while others outright prohibit financial trading.

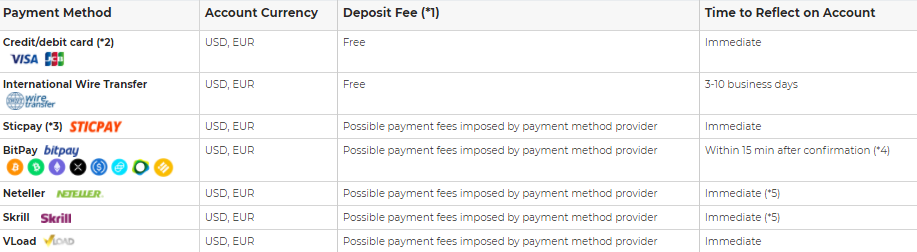

Making deposits and withdrawals at Axiory

Moving on, let’s have a look at the financial platforms that facilitate deposit and withdrawal processes at Axiory. If you can make these payments with fast and secure methods and without paying much in commissions, you can rest assured that your broker knows its business.

So, is Axiory legit with its payment methods? Well, let’s find out together. As we have discovered during our review, there are at least seven different financial platforms you can use for deposits and withdrawals. And each of them has pretty advantageous conditions.

First things first, the minimum deposit you need to make at Axiory is 100 USD. This ensures that people are serious about their decision to start trading but still the entry threshold isn’t too burdensome to hinder potential new clients for Axiory.

And as for the payment methods themselves, here they are:

- Credit/Debit card – Base currencies: USD, EUR; immediate transactions; no deposit commissions | 200 USD minimum withdrawal; 3-10 business days; no withdrawal commissions.

- International wire transfer – Base currencies: USD, EUR; 3-10 business days; no deposit commissions | 200 USD minimum withdrawal; 3-10 business days; payment for international remittances.

- BitPay – Base currencies: USD, EUR; 15 minutes after confirmation; possible fees from the provider | 200 USD minimum withdrawal; 1-5 business days; fees might be charged.

- Neteller – Base currencies: USD, EUR; immediate transactions; possible fees from the provider | 200 USD minimum withdrawal; immediate transactions; fees might be charged.

- Skrill – Base currencies: USD, EUR; immediate transactions; possible fees from the provider | 200 USD minimum withdrawal; immediate transactions; fees might be charged.

- Sticpay – Base currencies: USD, EUR; immediate transactions; possible fees from the provider | 200 USD minimum withdrawal; immediate transactions; no withdrawal fees.

- VLoad – Base currencies: USD, EUR; immediate transactions; possible fees from the provider | 200 USD minimum withdrawal; immediate transactions; no withdrawal fees.

As you can see, most of the above-mentioned payment methods have no commission charges, and those that do, their commissions come from service providers, not from Axiory, which takes further increases our favorable Axiory opinion.

Research prior price movements with Axiory

Being able to analyze past price movements and speculate how they’ll perform in the future is one of the main techniques traders use to increase their profitability in the market. And it’s their brokers’ job to provide them with the most useful and sophisticated research tools and features.

By choosing Axiory, you’re getting a platform full of technical indicators, economic calendars, financial calculators, and charting mechanisms. All of these tools can come in handy to more or less accurately predict upcoming price fluctuations in the market and open more successful positions.

Technical indicators

As we have already noted previously in this Axiory Forex broker review, by using technical indicators and conducting technical analysis, you can predict future price movements to a certain accuracy. And this is a very useful strategy to place profitable trades.

By choosing Axiory, you can get more than 60 different technical indicators, including oscillators, volatility channels, and many more.

Autochartist

Axiory offers you a bunch of manual charting mechanisms with different layouts, be it linear, bar, or candlestick charts. But that’s not all: it also offers an automated Autochartist tool, which observes the price movements on its own and notifies you when it’s the best time to place an order.

Calculators

When it comes to financial trading, especially one that is conducted online, there are many different variables that might be confusing for many people. For instance, you might have a hard time translating margins, swaps, and pips into real-world numbers.

For that, you can use Axiory’s calculator tool that helps you turn complicated values into more understandable concepts.

Improving education with Axiory

As our Axiory review shows, the broker not only cares about equipping you with the most sophisticated trading tools and platforms, but it also helps you improve your knowledge in financial trading, whether it’s in Forex, stocks, or other markets.

During the review, we found a number of different educational panels available on Axiory’s website. These panels include Axiory’s Trading Academy, online lectures, and a standalone demo account. Let’s take a look at each of them.

Axiory’s Trading Academy

The primary educational section at Axiory is its Trading Academy. It consists of dozens of insightful articles that fully explain what online trading is and how it works, as well as which strategies you can employ to increase your chances of success.

The covered topics within Axiory’s Trading Academy include:

- Basics

- Trading Terms

- Platforms

- Trading Psychology

- Economic Indicators

Online lectures

Financial analysts and experts working at Axiory are regularly putting out their analyses about various economic and political developments that affect market prices. By using these Axiory opinion analyses, you can have an even higher chance of success in the market.

Axiory’s customer support

To top our review off, let’s talk about Axiory’s customer support and how easily you can get helpful assistance from the broker. As we have discovered, Axiory currently offers four different ways of communicating with it:

- Phone call: +442031502506 (UK)

- Email support: [email protected]

- Live chat available on the website

- Headquarters: No.1 Corner of Hutson Street and Marine Parade Belize City, Belize

While all of these methods are quick and insightful enough, you can decide on which specific benefits you want to get and choose the communication method accordingly. For example, for faster responses, live chat and phone calls might be a better option, whereas email and in-person support are more useful for deeper interaction with the broker.

During our review of Axiory Forex broker, we also found out that the broker’s services are available in six different languages:

- English

- Arabic

- Japanese

- Portuguese

- Russian

- Spanish

What’s our final verdict?

Now that we’ve talked about all of the major and minor aspects of Axiory’s trading platform, can we actually recommend it to you? Well, let’s do a quick round-up once more.

Axiory is a Belize-based Forex broker that has a proper IFSC license, as well as is a member of the Financial Commission. This ensures that when you deposit your funds to your Axiory account, as well as place new trades, you won’t have to be concerned about your financial security.

As for the financial assets to trade, Axiory offers four different assets: currencies, CFD indices, energies, and metals. And conditions on these assets are quite impressive: the maximum leverage at 1:777 and minimum spreads at 0.2 pips.

Ultimately, these and many other conditions prove that Axiory is a top-notch trading brokerage that won’t disappoint anyone. Therefore, we can recommend it with an open heart!

Comments (0 comment(s))