Finq.com review – trading conditions and regulation

Finq.com is a Forex brokerage operating in the global markets besides the European Union and the United States. Every country that has securities trading, Forex trading and all financial assets legalized is able to accomodate Finq.com.

Considering the fact that South Africa is becoming a hotspot for Forex brokers, it’s not surprising to see Finq appear on our markets as well. However, it currently doesn’t hold an FSCA license, or at least it doesn’t show that it holds one. Although we’d be immediately poised to tell you to stay away from this broker due to the lack of license, we have to make an exception, simply because Finq is a world-known brokerage.

The question of the day “Is Finq.com legit?” needs to be answered thoroughly in this review, which will be exactly what we target. Therefore try to catch all of the points being made in favor of the nature of their regulation as well as the showcasing of their trading conditions compared to other companies in the South African market.

Finq.com review – does it have a legit license?

When it comes to identifying Finq’s license it’s a bit of an involved process. To put it into perspective we need to name all of the owners of the brokerage. First, there is the Dilna Investments Ltd, under which Finq operates. And then, there’s the parent company of Dilna Investments, Leadcapital Corp Ltd, which is licensed and registered in Seychelles.

We visited the FSA website and the company does indeed hold a legitimate license. In most cases we’d brand Finq scam a reality at this point, as a hereditary license is never encouraged from our part, but judging by the fact that the company has been operating form more than a few years and traders haven’t been having any problems, it’s redundant to even speculate about their legitimacy.

The transparency is also commendable as the company doesn’t hide its complex hierarchical system of subsidiaries upon subsidiaries. In the end, we believe that Finq is indeed trustworthy and legit brokerage.

Does it have good trading conditions?

Any good Forex broker review should focus on the trading conditions of the company and this Finq.com review is no different. Since we’ve already established that Finq.com is a legitimate brokerage with a legitimate license, it’s important to now determine if it’s worth it to trade with them in the grand scheme of things.

This will include things like spreads and commissions, the leverage applied and any other fees that trades may have to face. Let’s first start with the leverage s that’s mostly what determines the value the most.

Leverage

Thanks to the fact that Finq.com does not operate in the European Union, they don’t have to place a cap on their leverage offerings on various financial assets. One such trading option is Forex currency pairs, which always have the largest leverage out of all the trading assets.

With Finq.com, traders get around 1:300 maximum leverage that they can use for their trades. However, remember that this is a maximum cap for major currency pairs like EUR/USD, other pairs that are classified as exotics, could have a much lower cap.

Spreads

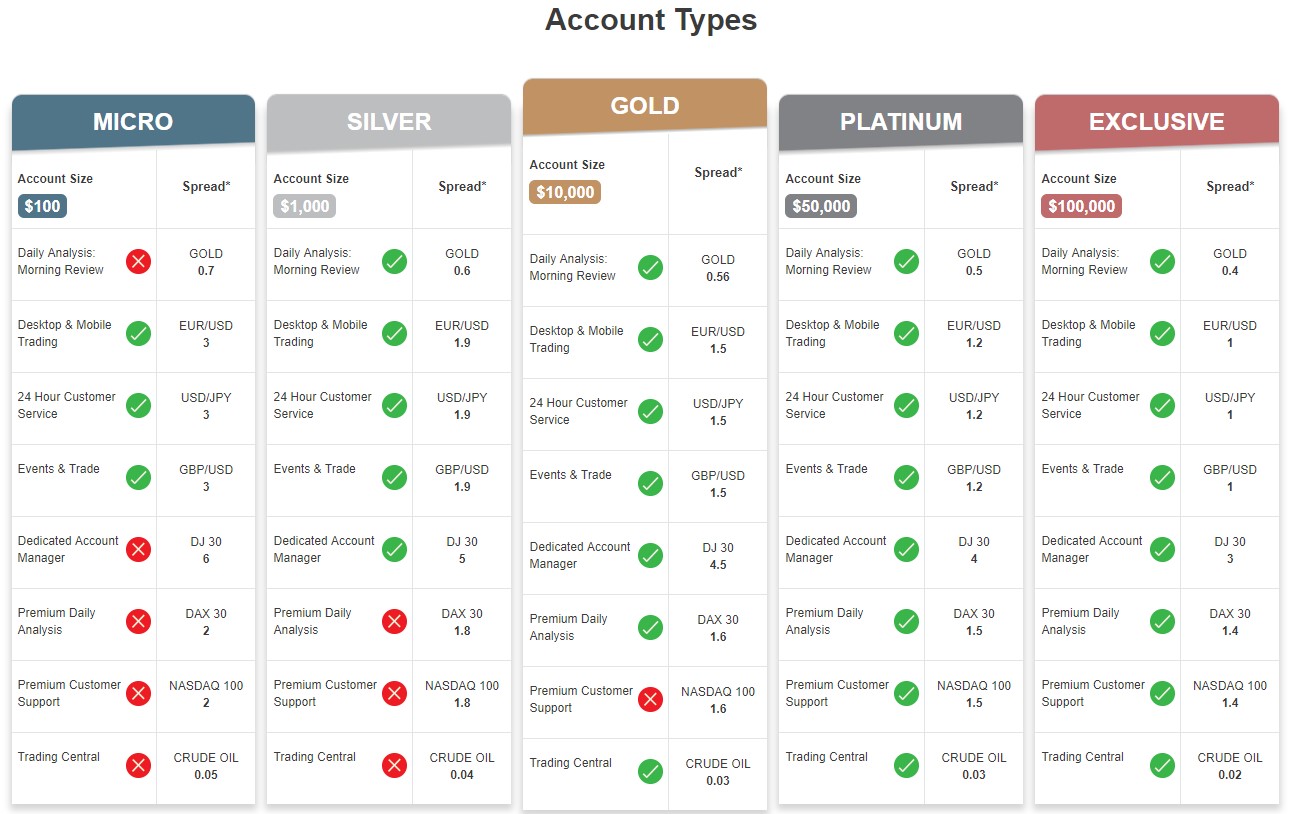

When it comes to spreads, it’s impossible to say just one thing about all the offers that Finq has, simply because of the diverse nature of its account types. Because of this, we have to name the range at which the broker operates its spreads, which is from 1 pip to 3 pips based on the account size.

To be honest, once we saw that the spreads are this wide we were going to brand Finq fraud as something of a possibility, but judging by the leverage, traders can still churn a quick buck out of their investments.

Trading platforms

There are two platforms that Finq.com users can choose in terms of software. There are the Webtrader desktop application and the MT4 software that is the most famous among not only South African traders, but traders from all over the world.

The diversity here should definitely be commended as it’s not often we see brokers commit to more than one trading platform, and even yet, diversify them across various devices.

Finq withdrawals and deposits

When it comes to withdrawals and deposits, Finq also has a few tricks up its sleeve. Those tricks involve multiple payment methods such as Wire transfers credit/debit cards and also third-party payment providers like Neteller and Skrill.

Finq withdrawals come with limits though. The minimum withdrawal with anything but Wire transfer is $20, and with a Wire transfer, it’s $100. Anything below this amount will warrant an additional fee.

Finq Account Types

This department is also more or less beneficial for the user base as it comes with huge diversity. Although the accounts have a large difference between price tags, it needs to be mentioned that there will always be a trader who will feel accommodated by the minimum deposits.

Can Finq.com be trusted?

We need to look at Finq as a broker that primarily focuses on jurisdictions that lack professional companies catering to their needs. Despite the fact that Finq does not posess a license with FSCA, the FSA license still allows them to legally cater to the South African Forex trader base, therefore making them a trustworthy brokerage.

So, is Finq.com trustworthy? Most definitely so? Are they worth trading with? Well, that depends on what you want to get from your involvement with them. Do you want to maximize your profits? Better go with a slightly more expensive account then. That’s probably the only thing keeping us back from giving Finq a 5-star rating, but nonetheless, it’s a solid brokerage with solid offerings.

Comments (0 comment(s))