Investous review will give you detailed insight about the brokerage

Forex brokers nowadays are trying to impress a potential customer with the design of the website and various offers that seem too good to refuse. It requires an experienced eye to see through the marketing tricks and find out what really is on the surface. Investous Forex broker is one of those brokerages that try to use the website to make its service look legit and desirable. Taking a look at the broker’s website might make you think you came across to the descent brokerage that matches all your criteria. If you have been interested in Forex trading for a while you should already know that the first impression is not always the right here. In this Investous review, we will try to give more insight about the broker, its features, background and services to answer the question can the broker be trusted or is it another camouflaged scam?!

Investous.com review

Investous.com review

The first touch point with the broker is through its website. The website of the broker looks well organised and modern. At first sight, the broker seems to provide all the information an investor might need. You can directly access the trading page, educational centre, account information and legal information. However, going to the pages is pretty much disappointing. If it can be compared to anything the website is like a nice looking house which is completely empty and broken down. While it seems from the surface that the website is well-organized, Investous.com review showed us that it is hard to find any important information there.

On the educational centre, the broker provides basic information about Forex trading such as glossary and fundamental and technical analysis. The content is very short, scarce and we could not think of anyone that could find it helpful in any way. Definitely, the broker has an educational section just for the sake of having it. These pages are not really for the traders to gain additional education but for the broker to seem more legit. Besides the content, Investous FX brokerage also offers educational videos about Forex basics and advanced technical analysis. Unfortunately, as the content, videos are too short as well and do not provide any valuable information to the visitors.

Apart from the content, the website does not work quite well overall. It loads slowly and landing from one page to another is slow as well. It indicates that the broker does not care much about the website and has not put enough investment in it, which once again makes us think if the Investous scam is real. On the website, the broker claims to have Forex awards as the best trading platform of 2018 and best execution broker in 2018. However, it makes sense to doubt these awards as there is no additional information and any indicator who had awarded the broker with this fancy looking titles. After all, it only takes minutes to create an award logo for yourself and put it on the website. Many fraud brokers do so and lie about the awards, and once you see the broker is misleading you with one lie, you might think of the other ways the broker might be luring you into creating an account with them. Hence, you might be wondering can Investous be trusted after it? Our answer is no.

The legal background of Investous FX brokerage

The legal background of Investous FX brokerage

After all, everyone might have a subjective idea about the website and the content that is placed there. Therefore, let’s take a look at the background of the broker and its regulations. Investous is the trading name of the company IOS INVESTMENTS Limited which is Belize investment firm. As you might have guessed it is regulated and licensed by the IFSC, International Financial Services Commission of Belize. Our long-time readers know that IFSC is not one of the most reputable regulatory bodies that you can think of. The offshore regulations are one of the best ways for the fraud brokerages to scam the investors and at the same time still have a license. Due to this, Belize is known as a haven for such brokers. It raises red flags and convinces as in Investous fraud. Last but not least, the broker claims to be an international, however, it does not have any other regulations which would enable it to provide its services in different countries, meaning that traders who choose Investous as a broker do not have any protection whatsoever, against the fraud.

Account types

Account types

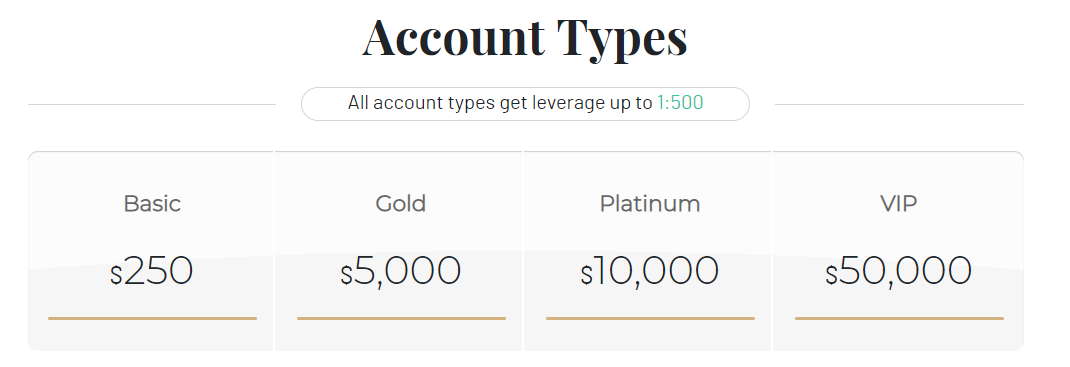

One can choose from four different accounts with Investous. The broker offers basic, gold, platinum and VIP accounts. Generally, the brokers offer several types of accounts so that traders can find the right one for themselves based on their trading portfolio, size of the investment, experience and goals. However, the way that Investous trading accounts are set up tries to drive the customer to the Gold account. The gold account has significantly better offerings than the basic account. When there is a very little difference between the Gold and platinum or platinum and VIP accounts. This formes a negative Investous opinion as the broker is clearly favouriting the account with the minimum deposit of $5ooo.

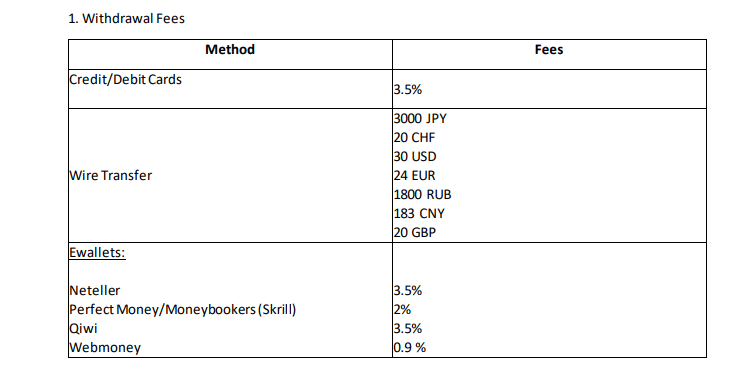

Now let’s take a look at the fees that come with the Investous accounts. The broker charges commissions on withdrawals for every account except the VIP one. The withdrawal fee for the credit/debit card is 3.5 %, for the withdrawals via different Ewallets the broker the commission is between 0.9 – 3.5%. For the Wire Transfer, the fee is fixed in different currencies, it can be 30 USD, 20 GBP or 24 EUR. Investous withdrawals are not bad only because of the commissions. The broker reserves the right to charge a 50 EUR withdrawal fee for various reasons that can possibly make it impossible for the trader to get withdrawal without the withdrawal fee plus the additional 50 EUR.

Apart from the withdrawal fees, the broker is also charging the inactivity fee. It is not very unusual, many trustworthy brokerages around the world have the inactivity fee. The difference between them and Investous is the period of time and the size of the fee. While reputable brokerages charge little inactivity fee after approximately six months of inactivity, the Investous broker charges it after one month only. From one to two months the broker charges 10 EUR, from two to three months 80 EUR, from three to six months the fee is 120 EUR and it increases up to 200 EUR over time.

Investous reviews

Investous reviews

Reading reviews made by the customers of the broker can help you determine if the broker is legit or not. Unfortunately, there are no reviews made by the customers that can be a really good sign that Investous scam is a real thing. The brokerage was established in 2018, and since it claims to have the award of the best execution broker in 2018 it should already have an audience of satisfied customers. However, there are none of the reviews talking about the positive experience with the broker. It makes us think that the relatively new broker does not really have traders that are satisfied with the service and is only trying to lure the customers to scam them. In any way, I would not advise starting trading with Investous to anyone.

Is Investous legit Forex broker?

Let’s sum up what do we know about the Investous FX brokerage and how trustworthy is it. The broker is licensed by the IFSC Belize and is not regulated by any reputable regulatory body. Although it claims to be international. It is hard to believe that the awards the broker claims to have are legit, as it does not provide any additional information about it. After all, it is impossible for newly established brokerages to get such awards when there are well-experienced brokerages that offer one of the best services to their customers. Investous tries to attract the customers with a simple and modern design but if it takes several minutes to understand that there is nothing valuable there. At the same time, the broker tries to convince the customers to open a gold account, charges multiple fees and makes the withdrawal complicated. Last but not least, there are no reviews about the brokerage that is quite suspicious. Overall the facts are convincing that Investous fraud is real and traders who care about their investments should avoid the broker at all cost.

Comments (0 comment(s))