In a world of financial trading, foreign exchange is the biggest market by a huge margin. It attracts millions of people, trillions of US dollars, and a huge number of service providers that all work in tandem to make up this giant that is shortly called Forex.

Currently, the Forex trading community is well-aware of some of the most popular success stories that have given birth to millionaires, and even billionaires, out of this form of exchange. And as an influence of that, every new Forex trader has this goal to be like them and generate as much money as possible.

However, despite there being multiple Forex trading millionaires/billionaires, it wouldn’t be a mistake to say that not everyone is going to succeed at trading, regardless of which market they’re trading on. According to the statistics, more than 90% of the traders are likely to fail, and there can be multiple reasons why that might be the case.

In this article, we will go through the richest Forex traders 2021 has got so far, and how they managed to stay above the average line, even above the upper line. So, without further ado, let’s see the top 4 richest people in Forex, as well as their trading psychologies.

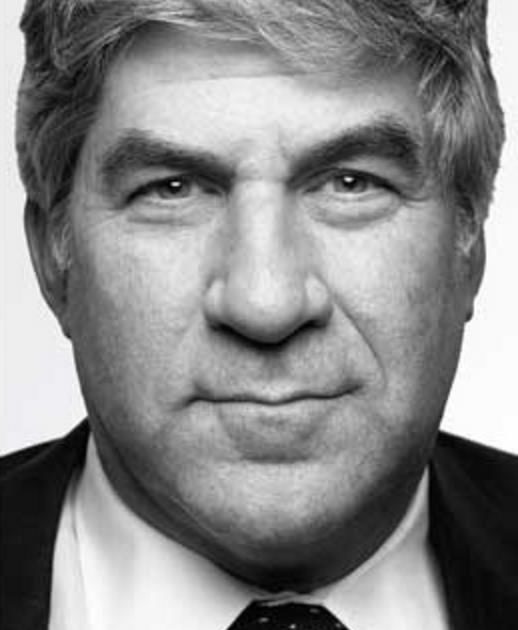

George Soros – 8.7 Billion USD

If there is one particular person to name during the discussion about the most successful Forex traders, that definitely should be George Soros and his extraordinary trading career. In Forbes’ Ranking of Billionaires, Soros is ranked #162 with his huge 8.7 billion USD fortune.

History and trading career

George Soros is a Jewish Forex trader and financial magnate, born in 1930 in Budapest, Hungary. He lived through the terrible times of World War II, as well as the Nazi occupation of his home country, which is why he fled Hungary and moved in the UK in 1947.

Soros attended the London School of Economics there, which he graduated successfully, and shortly after that, he began his business career in small-time merchant banks. It was not long after that that Soror founded his first hedge fund. It was called the Double Eagle, which then was quickly changed into the Quantum Fund.

Another hedge fund founded by Soros, and the one that most contributed to his becoming of one of the richest Forex traders in the world, was simply called the Soros Fund Management. Interestingly enough, the Soros Fund Management was built upon the profits received from the Quantum Fund in its first year of operations. Over their long-term operations, Quantum Fund collected around 25 billion US dollars, whereas the Soros Fund Management is still going, currently being at over 40 billion dollars.

Soros’ flourishment as a Forex trader – or more like his burst – happened in 1992 during the terrible economic crisis in the UK. During the entire meltdown, shortly known as Black Wednesday, Soros sold British pound sterling that was worth 10 billion US dollars. This whole accolade resulted in him generating a mind-blowing 1 billion USD profit, during the time when everything else was falling apart; that’s why the entire world knows him as “the man who broke the Bank of England.”

Soros’ trading psychology

When it comes to the trading psychology that George Soros used to achieve such an outstanding success in trading, it was quite simple in concept, yet it resulted in a multi-billion-dollar career.

Basically, Soros believed that engaging in short-term trades with higher leverage rates would produce more results than long-term investments. In his opinion, individual traders that massively implemented such strategies were significantly affecting the market conditions, and often times, resulting in periodic bubbles that then burst into huge financial crises, just like the Black Wednesday that took a serious toll on the UK.

Bill Lipschutz – 300 Million USD Annually

In our list of the richest people in finance, Bill Lipschutz is definitely an A-lister. In the zenith of his career, Lipschutz has been making over 300 million US dollars every year, which isn’t something to frown upon.

History and trading career

Lipschutz was born in 1956 in Farmingdale, New York. Born and raised there, he then left for Ithaka, NY, to attend Cornell University on two major programs – Architecture and Finances.

The event that changed Lipschutz’s life was the death of his grandmother, who left him 12,000 USD worth of shares in more than a hundred different companies. And for quite heavy commission charges, Bill managed to liquidate all of these shares and put them together in one portfolio.

With this initial capital, Lipschutz made some investments here and there. He also learned as much as he could about financial trading. Added together, he managed to grow his capital from 12,000 USD all the way to 250,000 USD. However, it wasn’t long after Lipschutz made a bad financial decision and wasted the entire money – although, he always mentioned that this was a lesson that made him a successful trader.

During his employment at Salomon Brothers, Lipschutz became one of the A-listers of the newly-created foreign exchange department, which, retrospectively speaking, helped him make it in the list of rich and successful traders.

It was in this company that Lipschutz made millions for the company, as well as for himself. And by the yar 1985, he was already earning 300 million USD every year. From 1995, Lipschutz works at the Hathersage Capital Management as a Director of Portfolio Management.

Lipschutz’s trading psychology

According to Lipschutz, the biggest contributor to your success as a Forex trader is to be passionate about the process itself; profits will inevitably come as a consequence. Moreover, he suggests that traders who remain moderately active and pursuing only one trade at a time have more chances of success than those who have multiple simultaneous trades. By concentrating on just one position, people can increase their productivity, make more effective decisions, and gain larger profits, argues Lipschutz.

Bruce Kovner – 5.4 Billion USD

With quite an extensive fortune of 5.4 billion US dollars, Bruce Kovner is yet another honorable member of our list of the top rich Forex traders. Kovner is famous for his rational thinking and cool resolution about him, which is why it is ever more interesting to take a look at his story.

History and trading career

Bruce Kovner was born in 1945 in Brooklyn, New York. After school, he graduated from Harvard University for Political Economy, which he also substituted with being a cab driver, political campaigner, and many other things.

Kovner found his love for passion somewhere around that time, and in 1977, he placed his first trade for soybeans futures. While it was a huge financial toll on his credit card, this trade proved profitable and it brought Kovner some 40,000 USD in profit. Unfortunately, though, that profit quickly went up in flames after being engaged in a losing position. The lesson that Kovner learned from this experience was that he shouldn’t have waited too long for a losing trade and instead, withdrawn his money as quickly as possible.

After that, Kovner started working for the Commodities Corporation. Already there, he demonstrated that he had his way paved for being the world’s richest Forex trader; Kovner earned his company millions of dollars, and he was always an employee that never lost his cool.

In 1983, Kovner established his own company called the Caxton Associates. In its high years, Caxton Associates managed more than 14 billion US dollars, proving that Kovner was definitely a man to entrust financial trading.

Kovner’s trading psychology

As for Kovner’s trading psychology – one that made him a multibillionaire Forex trader – was all about being rational and using various tools and features to predict the upcoming asset prices.

Kovner successfully used both technical and fundamental analyses to observe current economic developments, analyze price movements, and try to speculate the next movement direction. The reason why he became one of the richest people trading Forex was his ability to spot opportunities in developments that would definitely affect price conditions.

On top of that, and unlike George Soros, Kovner believed more in long-term investment-type trades – the ones that leveraged the full potential of analyzed trades and planned positions.

Stanley Druckenmiller – 4.7 Billion USD

The last person in our list – yet definitely not someone to take lightly – is Stanley Druckenmiller. Employing a rather counter-intuitive risk management strategy of not diversifying financial portfolios, Druckenmiller has set himself apart as one of the most successful Forex traders, and has ultimately gathered a huge wealth of 4.7 billion US dollars.

History and trading career

Stanley Druckenmiller was born in 1953 in Pennsylvania to a middle-class family. When he was 22, in 1977, Druckenmiller started working at the Pittsburgh National Bank.

The way he handled things there already made it apparent that Druckenmiller would be a great financial manager: in just one year, he went from being a low-tier practitioner to a head of the entire equity research department.

Four years after his career at the Pittsburgh National Bank, Druckenmiller started his own company called Duquesne Capital Management. It was at that time that he kickstarted his career as the richest man trading Forex. On top of that, he was also appointed the head of the Dreyfus Fund, which was an additional impetus to his success.

Now, the biggest contributor to Druckenmiller’s trading career was the fact that he participated in the 1992’s UK financial crisis – Black Wednesday. He worked with George Soros at the Quantum Fund during that time, and alongside him, Druckenmiller made a huge fortune and also became a famous “man who broke the Bank of England.”

In 2010, his company underwent a serious financial crisis, which was the main reason why he retired from it. He later explained that seeing his company fail and not live up to his expectations forced him to step down. And the financial crisis in the Duquesne Fund was quite visible: from an average of 30% annual income, the company went down to -5%.

After a short period of time, Druckenmiller returned to a recovering company. But it wasn’t for good: he only got back to pay all of his debts and make things even, after which he closed down the entire company.

Druckenmiller’s trading psychology

So, why exactly did Druckenmiller become one of the richest traders in the world? Well, he incorporated a somewhat backward-thinking strategy, and here’s what that means:

One of the most popular risk management strategies that you’ll hear everywhere is the diversification of your portfolio. This is a pretty viable strategy that advises people to invest in more than one financial instrument. This way, a diversified portfolio will make sure that the risk of destroying the whole account balance decreases significantly, while the inflow of profits doesn’t stop.

In Druckenmiller’s trading psychology, things go exactly the opposite way; he advises to put “all eggs in one basket” and have a monogamous trading portfolio. As Druckenmiller argues, this will drastically increase the profits that you’re expecting. However, he also warns that people shouldn’t trade all the time; instead, they should be like snipers, waiting for that perfect chance to place a trade.

Another piece of advice from Druckenmiller is to always have a plan B – a backdoor to save your portfolio from a total disaster, should anything unexpected occur on the market.

Not everyone can be the world’s richest Forex trader

As we have seen in our list of the “richest Forex trader 2021,” being a super-successful participant of the exchange process requires a particular way of thinking – the one that allows you to see opportunities where regular people only see the danger.

This goes to show that not everyone will become a successful Forex trader, and certainly not the biggest phenomenon in the entire industry. Whether we’re talking about George Soros and his incredible ability to foretell the entire market disaster in the early 1990s, or Stanley Druckenmiller and his going against the curve and putting “all eggs in one basket,” it takes a lot of effort, mentally and physically, as well as a moderate level of luck, to actually make something of yourself in this business.

But it’s not to say that achieving this is totally impossible. Again, the above-mentioned four traders were regular people before they kickstarted their careers at some point in their lives. And through self-discipline, experience, and the ability to seize the moment, they have become the richest Forex traders in the world.

Comments (0 comment(s))