AMarkets Review – Orders Under 0.03 Seconds

AMarkets is a multi-instrument trading brokerage with a license from the Financial Services Authority from Saint Vincent and the Grenadines. Their license number is 22567, which does indeed appear in the regulator’s archives, thus making AMarkets a trustworthy entity. During our AMarkets review, we also discovered that the broker is a member of The Financial Commission, an independent self-regulatory body, created to solve disputes between companies and their clients. The organization providers insurance of 20,000 euros for each case.

AMarkets is also quite generous with its additional features when it comes to trading FX in particular. For example, the broker has a maximum of 1:1000 leverage and spreads as low as 0.2 pips on high-volume pairs such as EUR/USD. Additional benefits include extremely fast processing times, usually under 0.03 seconds, and a guarantee of zero commissions on deposits.

In terms of the minimum capital required to receive an account, Amarets forex broker requires 100 USD or 100 EUR, which is still relatively low compared to the market standards nowadays.

Overall, AMarkets is an above-average forex broker that has advantageous features for both beginner and veteran traders. Their license and membership in international organizations provide the safety required for a trader to sign-up.

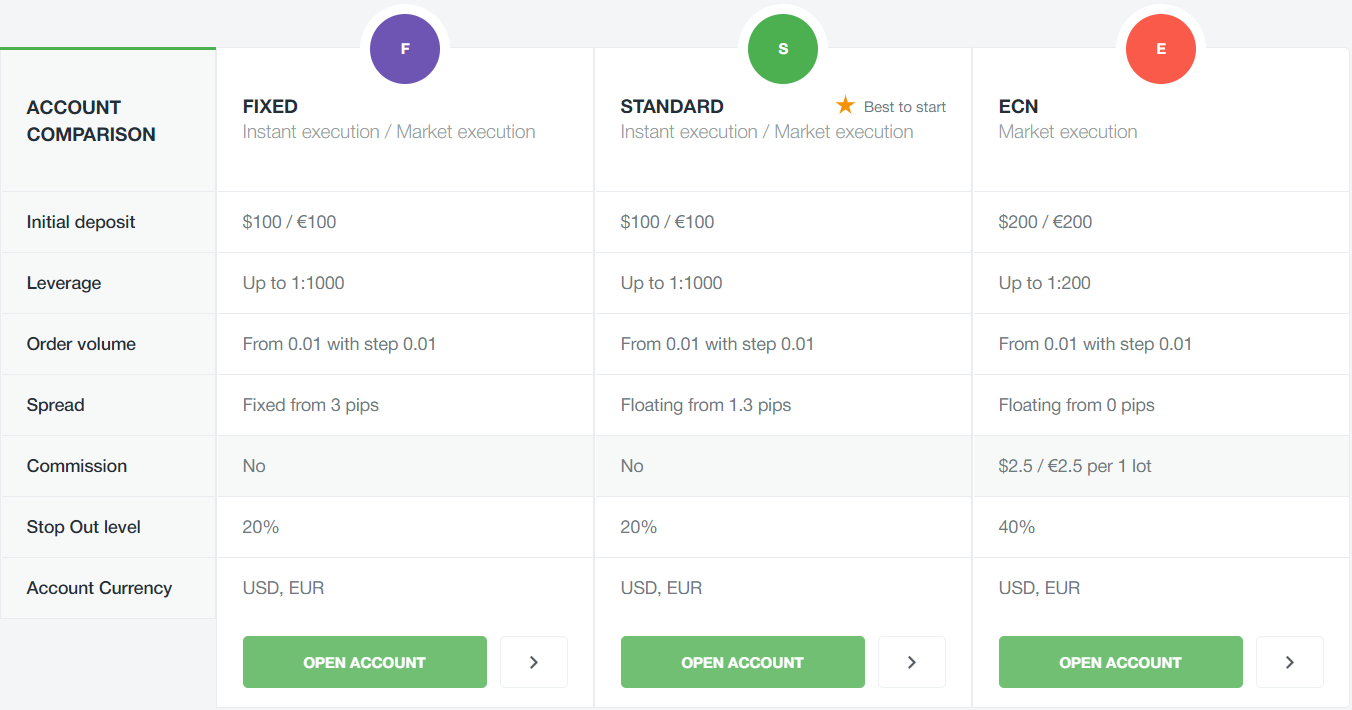

AMarkets Forex Broker – Account Types

AMarkets has 3 account types at the moment: Fixed, Standard, and ECN. Below you can find all the necessary information about each account type.

Fixed Account

This account type is rated as second-best by AMarkets itself, but it still has some beneficial features such as:

- $/€ 100 initial deposit

- 1:1000 leverage

- 3 pips fixed spread

- No commissions

- 20% stop-out level

Standard Account

The standard account is the most recommended AMarkets account type simply because it’s more geared towards beginners. Traders can expect the following:

- $/€ 100 initial deposit

- 1:1000 leverage

- Floating spread from 1.3 pips

- No commissions

- 20% stop-out level

ECN Account

ECN is the least recommended for beginners from what we’ve seen, but it is still an essential type to have for people interested in such features as:

- $/€ 200 initial deposit

- 1:200 leverage

- Floating spread from 0 pips

- $/€ 2.5 per 1 lot

- 40% stop-out level

AMarkets Bonus – How Much Can You Get?

There is only one AMarkets bonus type and that’s the deposit bonus. It is reserved only for clients using Fixed and Standard accounts. The bonus is 25% up to $/€ 5,000 per client. This means that a deposit of $/€ 20,000 is required to get the maximum value.

The funds are provided as non-withdrawable credits and need to be in constant action to persist on the account Should there be no activity on the account for more than 30 days, the bonus will be revoked.

AMarkets Overall Review

In conclusion, AMarkets is a very well-established forex brokerage with features ready to suit anybody’s needs, be they a beginner or veteran trader. Their trading features are generous or match the current industry standards. There is no unnecessary overhead and minimal payments for inactivity, or lack thereof for deposits and withdrawals.

The one thing that would be a big disadvantage for AMarkets would be that they only offer services in USD and EUR, no other currencies are accepted on the platform.

Comments (0 comment(s))