FXOpen Review – maximum trading flexibility

FXOpen Forex broker is an industry-leading brokerage firm first established in 2005. The company has 16 years of experience in the field of retail trading. The broker employs hundreds of professionals all around the globe with the main headquarters in Australia, the United Kingdom, and Nevis. FXOpen is famous for its live trading accounts diversity and a wide array of high-quality trading platforms.

FXOpen is mainly a Forex broker which also offers CFDs on numerous assets including cryptocurrencies, shares, indices, metals, and commodities. The traders can access and choose from four different account types, each suitable for various trading styles, capital, and risk tolerance. Furthermore, automated trading along with many different trading strategies including Expert Advisors, scalping, hedging, and news-trading are all welcome at the broker’s trading platform.

In addition to the trading assets and conditions, the broker provides multiple promotional campaigns with the intention to reward its loyal customers and encourage the new registering users. The programs include both performance-based trading contests and cashback campaigns that aid the traders who have been losing funds in their trades. Our review on FXOpen Forex broker will briefly summarize all the major features that the broker presents and assess the quality of the brokerage services that it provides.

Background and Regulatory Framework

FXOpen at first came into existence as an educational center in 2003. The center was operating within the field of technical analysis in Egypt. It was only after two years in 2005 that the company officially launched as a brokerage firm. For some time in the beginning the brokerage firm was not regulated or licensed and was basically conducting the business in a free flow. However, entering the second decade of the 21st century, brokers quickly obtained regulations in various jurisdictions. Nowadays, FXOpen regulation stretches to four regions that are Australia, New Zealand, the United Kingdom, and Nevis. In addition, the broker has multiple representatives in other countries and regions, as well. Overall, FXOpen employs more than 500 professionals across the globe.

The regulatory framework includes two official licenses from the regulatory authorities concentrated in the United Kingdom and Australia. In the United Kingdom, FXOpen broker is regulated by FCA, that is the Financial Conduct Authority. The FCA registration number is 579202 and the company, FXOpen Ltd is based in London. The license is active since 2013. In Australia, ASIC, or Australian Securities and Investments Commission recognizes the legitimacy of the brokerage firm. The ASIC license number is AFSL 412871. The company FXOpen AU Pty Ltd is based in Perth and holds a license since the July of 2012.

FXOpen Trading Assets

The trading assets or financial instruments portfolio as many call it includes various products across the range of markets. Obviously, as FXOpen is the Forex broker, major attention is paid to the Forex currency pairs. However, the broker incorporates many other products in the form of Contracts for Differences or CFDs. The traders can diversify their portfolio with CFDs on shares, stock indices, commodities, metals, and cryptocurrencies.

The FXOpen traders can access more than 50 currency pairs in the Forex market. On some of the accounts, they can trade with crypto pairs as well whereas the number of products within this asset portfolio exceeds 43 pairs. The cryptocurrency CFDs are also available and there are in total more than 25 crypto CFDs for the traders. Most of the account types furthermore allow various trading styles and strategies including hedging, scalping, Expert Advisors or EAs, and news trading. However, the applicable conditions to different financial instruments from the portfolio depend on the type of real trading account that the client owns with FXOpen.

Live Trading Accounts at FXOpen

FXOpen rating is relatively high compared to the top Forex brokers that operate within the same regions. Partially, it comes due to the fact that the broker offers multiple live trading account types. All of these accounts satisfy the requirements of different types of traders with appropriate strategy allowance. FXOpen traders can choose from four main account types and even choose the Islamic account option. FXOpen accounts provide various benefits to the customers including the most suitable trading conditions.

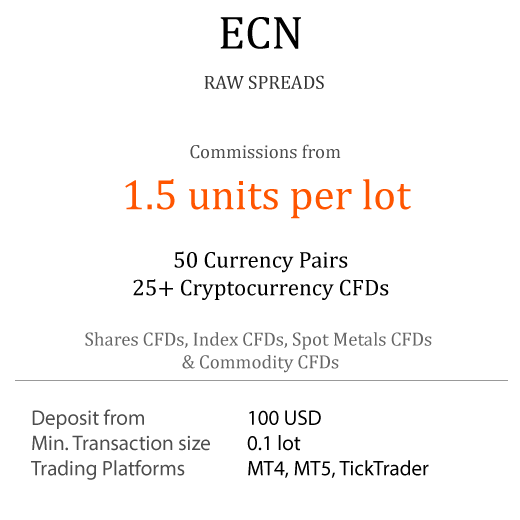

ECN account

- Available base currencies: USD, AUD, CHF, EUR, GBP, JPY, RUB, SGD, Gold*, mBTC

- Minimum deposit requirement: 100 USD (or the equivalent in another base currency)

- Spreads: floating, from 0 pips

- Commission fee: from 1.5 USD per Standard lot (100,000 USD)

- Minimum transaction size: 0.01 lots (or 1000 units of the base currency)

- Maximum leverage: up to 1:500

- Margin call & Stop out: 100% / 50%

- Islamic Account option available

- Financial instruments: 50+ FX Spot CFDs, 35+ Cryptocurrency CFDs, 600+ Shares CFDs, Index CFDs, Spot Metals CFDs & Commodity CFDs

- Allowed strategies: scalping, hedging, Expert Advisors, news trading, phone dealing

- Bonus programs available: discount programs depending on the trading volume

- Inactive account fees: maintenance – 10 USD per month, reactivation – 50 USD

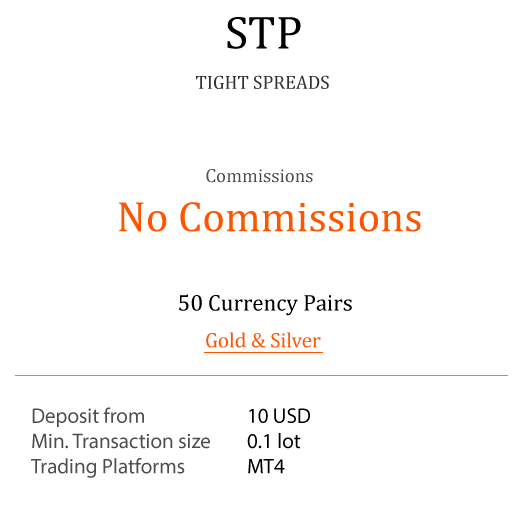

STP account

- Available base currencies: USD, EUR, GBP, JPY, RUB, CHF, Gold

- Minimum deposit requirement: 10 USD (or the equivalent in another base currency)

- Spreads: floating depending on the buy/sell orders available in FXOpen ECN

- Commission fee: not applicable

- Minimum transaction size: 0.01 lots

- Maximum leverage: up to 1:500

- Margin call & Sopt out: 50% / 30%

- Islamic Account option available

- Financial instruments: 50 currency pairs + gold and silver

- Bonus programs available: USD 10 for opening the first STP trading account

- Allowed strategies: scalping, hedging, Expert Advisors, news trading, phone dealing

- Inactive account fees: maintenance – 10 USD per month, reactivation – 50 USD

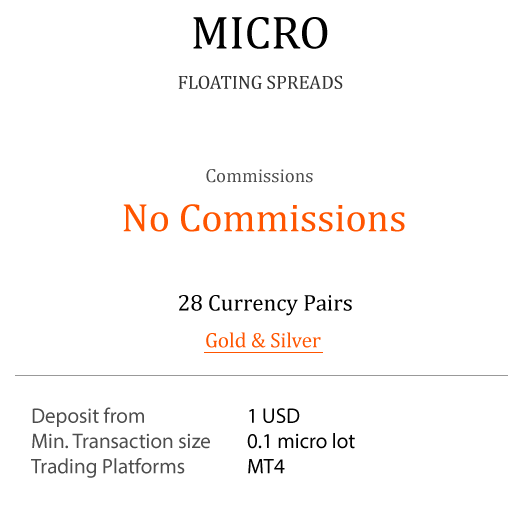

Micro account

- Available base currencies: USD

- Minimum deposit requirement: 1 USD (no other base currencies available)

- Maximum account balance: 3000 USD

- Spreads: floating

- Commission fee: not applicable

- Minimum transaction size: 0.01 micro lots

- Maximum transaction size: 1,000,000 USD

- Maximum leverage: up to 1:500, however, once the balance of a Micro account exceeds 3000 USD, the leverage will be decreased 100x

- Margin call & Stop out: 20% / 10%

- Islamic Account option available

- Financial instruments: 28 currency pairs in addition to gold and silver

- Bonus programs available: trading contests, cashback, other bonuses

- Allowed strategies: scalping, hedging, Expert Advisors, phone dealing

- Inactive account fees: 10 USD per month, reactivation – 50 USD

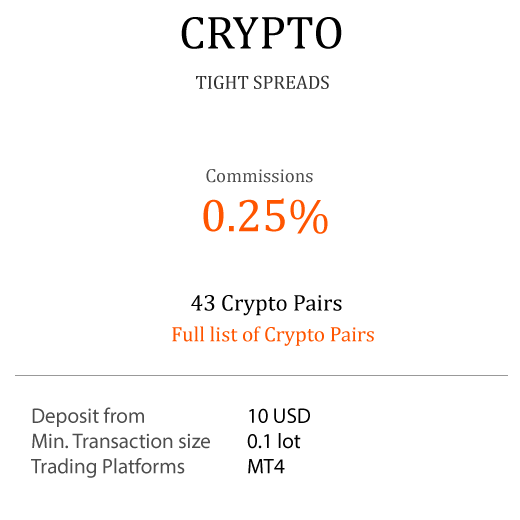

Crypto account

- Available base currencies: USD, EUR, GBP, RUB, JPY, ETC, Bitcoin (mBTC), as well as, Litecoin (LTC)

- Minimum deposit requirement: 10 USD (or equivalent in another base currency)

- Spreads: floating

- Commission fee: 0.5% half-turn

- Minimum transaction size: 0.01 standard lots

- Maximum leverage: up to 1:3

- Margin call & Stop out: 30% / 15%

- Islamic Account option not available, however, SWAP from 5% per annum possible

- Financial instruments: 43 pairs with BTC, BCH, EOS, Ripple, Monero, LTC, etc

- Bonus programs available: no bonuses

- Allowed strategies: scalping, hedging, Expert Advisors, news trading, as well as phone dealing

- Inactive account fees: 10 USD per month, reactivation – 50 USD

FXOpen Trading Platforms

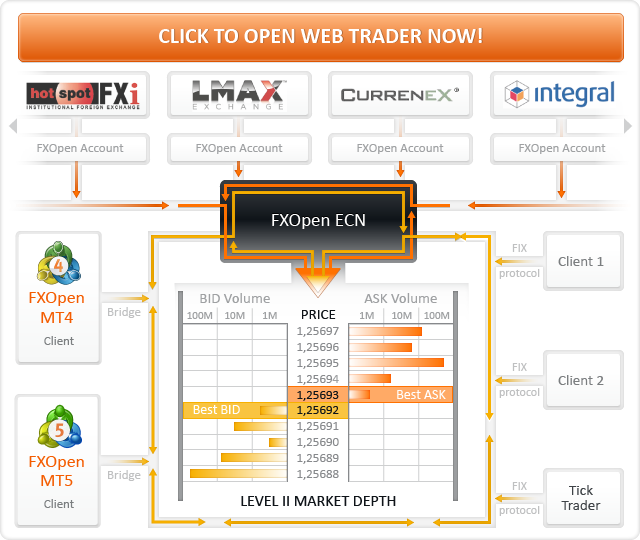

FXOpen opinion strongly supports the variety in trading platforms. In fact, the broker provides both the standard and common trading software, its own adaptations, and automated trading tools. However, not all account types can access every trading tool that the broker implements on its website. Some of the trading terminals are exclusive to certain accounts. For instance, ECN account holders can use the TickTrader platform as the broker establishes separate and dedicated TickTrader ECN account. Also, the various accounts need different modifications of the traditional software, such as MetaTrader 4.

Trading Terminals and Software

When it comes to trading platforms, FXOpen traders have a huge choice. They can go for MetaTrader 4, MetaTrader 5, TickTrader, WebTrader or even mobile trading. All of those platforms are highly reputable and reliable. Furthermore, the platform interfaces are extremely user-friendly and easy to navigate through them. TickTrader is an innovative trading terminal that offers Desktop and Mobile versions, level 2 pricing, one or double click mode, easily customizable interface, and strategy back tester. In addition, the platform provides a detailed chart system and trade alert system with ultra-fast order entry and execution.

When it comes to trading platforms, FXOpen traders have a huge choice. They can go for MetaTrader 4, MetaTrader 5, TickTrader, WebTrader or even mobile trading. All of those platforms are highly reputable and reliable. Furthermore, the platform interfaces are extremely user-friendly and easy to navigate through them. TickTrader is an innovative trading terminal that offers Desktop and Mobile versions, level 2 pricing, one or double click mode, easily customizable interface, and strategy back tester. In addition, the platform provides a detailed chart system and trade alert system with ultra-fast order entry and execution.

MetaTrader 4 and 5 need no presenting or introduction from us, as they are already well-established and highly popular software options for various traders. These platforms are multi-asset trading terminals that can be downloaded and installed on every system. However, for more convenience, FXOpen Forex broker supports the web version of these platforms that integrate the original software. WebTraders can be accessed from any browser with ease and without any further requirement for downloading or installing them.

Forex Automated Trading

Algorithmic trading has been receiving a lot of attention lately due to its convenience and success rates. Automated Trading is conducted with the assistance of Expert Advisors (EAs). The traders can choose between the full or partial automation of trading processes. The choice further ranges from assistance to trading decisions to offline placing and canceling orders. In addition to the offered services, the algorithmic trading software can control the placed orders, monitor the trades, and analyze the market conditions such as volatility and liquidity. The software is written in MQL4/MQL5. It can interact with the MetaTraders and can even support the TickTrader platform as a trading bot.

Algorithmic trading has been receiving a lot of attention lately due to its convenience and success rates. Automated Trading is conducted with the assistance of Expert Advisors (EAs). The traders can choose between the full or partial automation of trading processes. The choice further ranges from assistance to trading decisions to offline placing and canceling orders. In addition to the offered services, the algorithmic trading software can control the placed orders, monitor the trades, and analyze the market conditions such as volatility and liquidity. The software is written in MQL4/MQL5. It can interact with the MetaTraders and can even support the TickTrader platform as a trading bot.

Most of the traders usually use automated trading technologies to conduct technical analysis. The logic behind automated trading is relatively simple. The traders can either purchase or code the auto trading program for Forex or crypto exchanges that would purchase one currency against another. These purchases occur under specific conditions, such as when the short-term moving average crosses above the long-term moving average. According to the traders’ instructions, the program will then cell a specific currency as soon as the price reaches the desired level for the trader. Nowadays, these programs are implemented for highly liquid Forex markets or retail segments such as cryptocurrencies.

FXOpen Promotions and Contests

We have already mentioned the specific bonus systems that apply to separate account types including the commission cost discount options for ECN and 10 USD welcome bonus for SPN accounts. Furthermore, the broker runs multiple promotional campaigns that are open to every user registered on the brokers’ platform. These campaigns include both the trading contests that are based on the performance of the traders and promotions, such as Forex cashback.

The trading contests operate on demo accounts. It means that these competitions are completely cost-free and involves no risk of losing any personal funds. The traders can open demo accounts without a deposit and can start trading with the virtual money credited by the broker on the virtual balance account. A trader who manages to earn the most profits during the contest duration will be announced as a winner. The winners receive various cash prices that range from 1000 USD up to 10,000 USD. The contests run on a weekly or monthly basis.

The Forex cashback program provided by FXOpen is a refund campaign set for specific conditions. When the traders start loss-making, the broker awards extra refunds to the traders and credits them to the trading account balance. This promotion applies to all live trading accounts of FXOpen and is available during the first 90 days from either requesting it for existing users or from registering for the newcomers. The minimum cashback amount is 5 USD and the maximum amount can reach 1,000 USD. On the other hand, the broker limits the maximum cashback amount per trade to 100 USD.

Comments (0 comment(s))