MTrading Review – Should you trust this broker with your money?

A Forex broker is an integral part of the trading process. It provides all the necessary tools and platforms that you need to have a full-fledged trading endeavor.

Unfortunately, the chances of finding a trustworthy brokerage are slowly decreasing amid the increased number of scam brokers on the internet. These brokers have learned to mimic their credible counterparts in terms of the trading software, terms and conditions, and the overall online experience.

However, you can still tell the two types of brokers apart by looking deeper into their platforms. In this MTrading review, we’re going to do just that – check out how the website looks, what the regulation is, and what the trading terms and conditions are.

The initial look

Before we delve deeper into the broker’s platform, let’s have a quick look at what we’re going to discuss in our review. So, MTrading is a Forex broker that was established in 2012 and provides access to instruments from different markets, including FX, stocks, and commodities.

When it comes to the website, it doesn’t look too bad at first glance. However, there are some areas that don’t look overly professional to us.

When it comes to information, we managed to find some of the most basic details about trading terms and conditions, licensing, etc. However, it wasn’t the most comprehensive information we’ve seen in our experience.

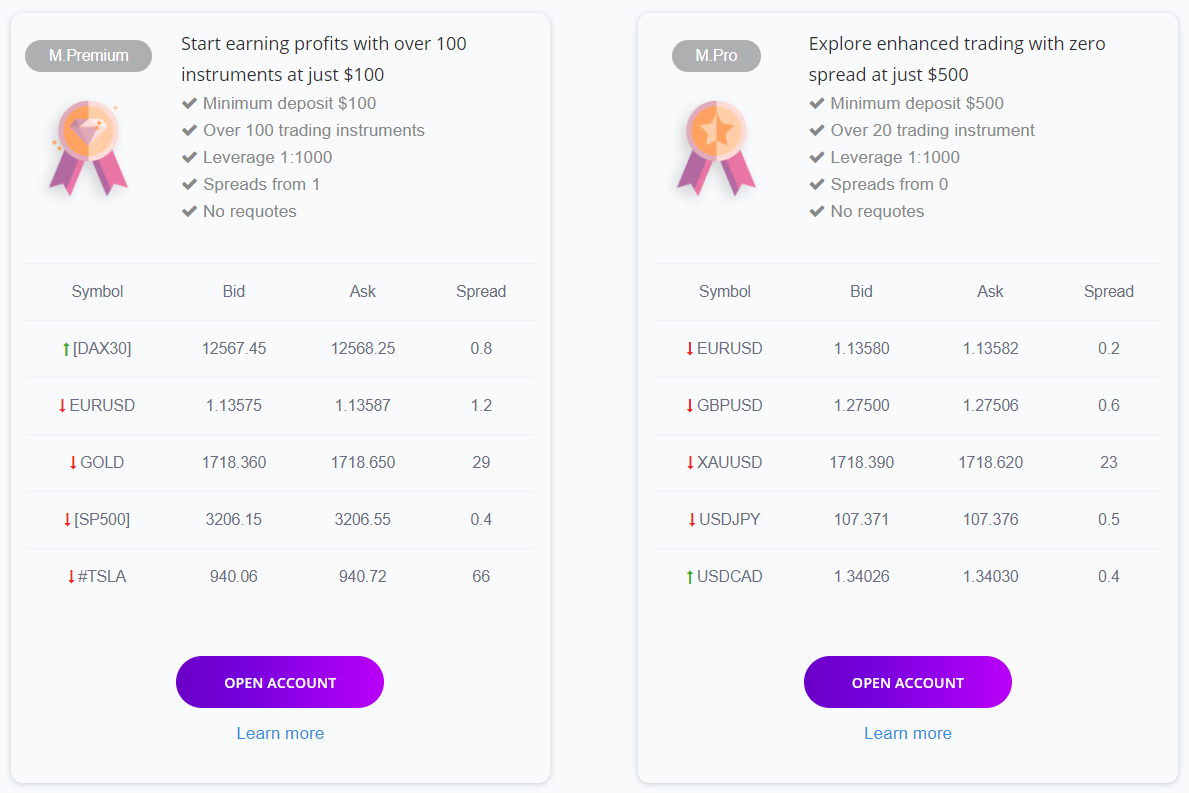

Next up, we tried to find out which account types you can get with the MTrading Forex broker and found two main packages: M. Premium and M. Pro. These accounts are more similar to each other than different when it comes to their leverage offerings and no requote conditions.

As for the trading platform, MTrading features MetaTrader 4 with a bunch of iterations, including the multiterminal, supreme edition, and the web trader. While we don’t really have anything against this software, we’d be happier if the broker also supported MetaTrader 5, which is more advanced for trading instruments other than Forex.

Moving on, we’ll check out the broker’s license and determine, whether its activities are properly regulated. As the website claims, MTrading was registered in St. Vincent and the Grenadines by the Registrar of International Business Companies. The license was issued by the Financial Services Authority (SVGFSA), which is a huge grey area that we’ll cover in the further part of the review.

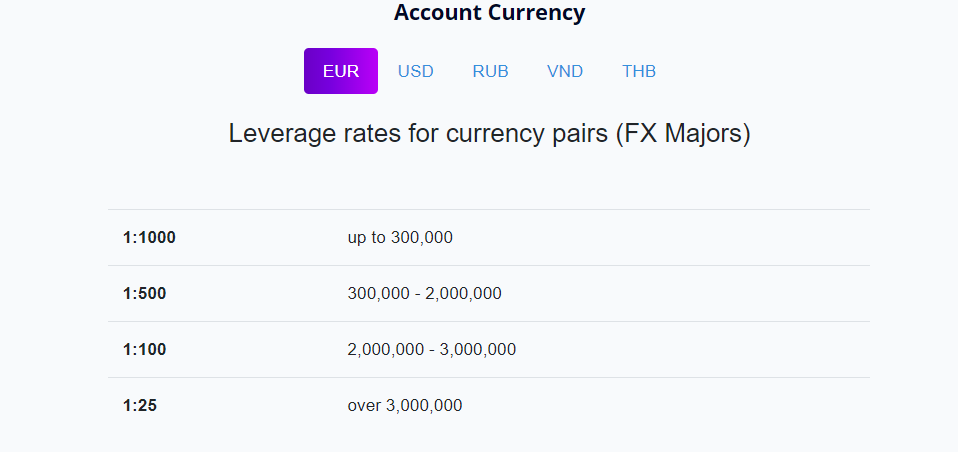

Finally, we’ll take a look at what trading terms and conditions you can get by registering at MTrading. Our MTrading review shows that the instruments available for trading are FX pairs, commodities, indices, and stocks. The maximum leverage you can get for these instruments is 1:1000, with the minimum spread of 0 pips.

As for the minimum deposit requirement, you can create a basic account for 100 USD, which is not too high nor too low. And in order to actually make these deposits, you can use quite a few methods that include credit cards, e-wallets, and bank transfer.

In general, the downsides of MTrading are far more pressing than its advantages, which suggests that there are quite substantial chances of a scam.

The detailed Mtrading.com review

So, now that we’ve taken a quick look at what you should expect with this broker, let’s dive a little deeper and check out the above-mentioned details more closely. First, we’ll start with the website. As noted earlier, the interface looks mostly decent with a blank background and easily-discernable fonts.

However, there are still some backgrounds and visual effects that don’t really compliment the whole experience on the website. As for the informative side of Mtrading.com, we can admit that the information is pretty easily accessible for the user. However, besides the most basic details, you’re not going to be able to find more comprehensive information, which is not ideal for more experienced traders.

When it comes to creating an account at MTrading, you can get two main packages:

- M. Premium – 100 USD min. deposit

- M. Pro – 500 USD min. deposit

In our MTrading opinion, these accounts are more similar to each other than different. For instance, they both stay away from requotes, offer the same leverage amount, etc. As for the differences, the M. Pro account has a starting spread from 0 pip, whereas the M. Premium account features more instruments.

Finally, let’s talk about the trading software that facilitates trading at MTrading. As we’ve already said, the broker offers a well-known MetaTrader 4 with a bunch of different iterations:

- MetaTrader 4 supreme edition

- MetaTrader 4 multiterminal

- MetaTrader 4 web trader

Now, the software itself is very stable and offers some of the best trading features on the market. However, it cannot stand in the way of a scam broker, which is to say the software can easily carry a Ponzi scheme just because the broker implemented it. In the next section, we’re going to explain why you’d have to be concerned about this issue.

Is MTrading’s license legit?

The main area that gives out the exact nature of the broker is its regulation. If it is fireproof in every angle, it can ensure you that there’s not going to be a threat of the scam. Conversely, a shady licensing can give away the scam that’s been brewing underneath shiny conditions.

The MTrading FX brokerage claims to be registered by a member of The Financial Commission. As for the license, it supposedly owns an SVGFSA license from the Financial Services Authority, which could trick some people and made them believe that the MTrading scam is not real.

However, our reviewing experience shows that with an SVGFSA license, a broker can never be trusted. This license is actually not legit because the SVG government doesn’t issue licenses for Forex brokers.

Therefore, we can pretty easily assume that MTrading is an unregulated broker and that it cannot be trusted with your money. Without regulatory oversight, this broker can take your money, convince you that it’s going to increase it significantly, and take it away for good. You’d rather find a broker that has a sturdier and more believable license.

What the MTrading promotions look like

The last entry in our review is going to be trading terms and conditions. If you do register at MTrading (which, as noted above, may not be the best idea in the world), you’re going to get Forex pairs, commodities, stocks, and indices.

With these instruments, you can get pretty crazy with the leverage and spreads, and here’s what we mean by that: while the majority of credible brokers offer leverage at around 1:300, MTrading goes way beyond the line by offering 1:1000 leverage. Some traders may be fascinated by such a high multiplication rate (and not without cause), but with high leverage come high risks: your chances of losing big increase exponentially.

The same MTrading scam suspicions spill over into the spread department. As we’ve discovered, the minimum spread you’re getting at MTrading is 0 pips. Now, a broker usually depends on spreads or commissions financially. It can either remove spreads (like MTrading does) in favor of high commissions, or the other way around.

But it’s always never the case for the broker to say no to both of these sources of income. And if it does, one has to be more suspicious about the broker being honest to you. MTrading may say it charges 0 spreads and commissions, yet there may be hidden fees, and not very legal at that, that significantly reduce your chances of success.

As for the minimum deposit requirement, we need to give the devil its due and admit that a 100 USD requirement is pretty normal and not overly suspicious. It ensures that the entry barrier is high enough, yet not too high that it is inaccessible to beginner traders.

Finally, we set out to find out how you can actually make deposits and withdrawals at MTrading. As we have found out, the broker supports a bunch of payment methods that range from traditional methods all the way to alternative ones. More specifically, you can make MTrading withdrawals and deposits via:

- Alfa-bank

- Astropay

- Manual operation

- Neteller

- Nganluong

- Perfect Money

- Prepaid card

- QIWI

- Skrill

- Visa/MasterCard

- WebMoney

- Wire transfer

It’s pretty apparent that MTrading really takes its payment platform up a notch. Yet, as we have already pointed out, zero commissions would’ve been a great deal if there were decent spreads, which is not something that you’re going to see at MTrading. Therefore, even in light of the multitude of methods, we’re still not impressed by MTrading’s financial platform.

Is MTrading legit? – A final recap

So, let’s do a final roundup of what we’ve just said and seen in this review:

MTrading is a Forex trading broker established in 2012 and operating from 10 offices around the globe. The broker offers even more tradable instruments from other markets, including stocks, indices, and commodities.

When we checked MTrading’s website, it was mostly fine but there were some inconveniences in terms of its design. As for the informative aspect, we were able to find pretty much every detail about how trading is done at MTrading, yet the information wasn’t very comprehensive for further insight.

As for the license, we’re pretty sure that the SVGFSA license that MTrading is boasting with is as good as the paper it’s written on. The SVG government has openly announced that it doesn’t regulate Forex brokers, which further boosts our MTrading fraud suspicions.

Finally, we checked out trading terms and conditions and found that 1:1000 leverage and 0 spread is even more suspicious on this platform.

Ultimately, we think that MTrading is a very suspicious entity and you shouldn’t risk your money with it.

Comments (0 comment(s))