OctaFX Review – can you trust this broker?

In online trading, just like in any other financial exchange, one of the most important requirements is to choose a partner that’s both credible and attractive. If these requirements are met, your trading will have much higher chances of success and ultimate profit. However, if they’re not, a bunch of problems arises at once.

Thanks to the proliferation of the internet, online brokerages are abounding in the market. And it becomes incredibly difficult to find credible ones among the ocean of scammers.

But this certainly doesn’t mean that there is a shortage of quality brokers in Forex. Far from that, actually. It just takes a little bit more effort and research to find such brokers.

To make our contribution to this search, we offer a review of the OctaFX Forex broker, which is considered one of the most popular FX brokerages on the internet. So, without further ado, let’s get going.

Initial impressions DO matter!

OctaFX was established in early 2012 and since then, the broker managed to acquire quite extensive experience and insight into the Forex markets. Apart from that, it has received many prestigious rewards in finances, including the Best ECN Broker Asia, Best Mobile Trading App, and many more.

So, it already looks like OctaFX is a widely-acclaimed broker. And when you look at trading terms and conditions, licensing, and website, you’ll know why it is so.

Trading promotions

Let’s begin by the actual numbers. OctaFX promotions are quite impressive and offer a lot of headroom for Forex traders. For example, the maximum leverage with this broker can reach as high as 1:500, which is a very profitable proposition if you know how leverage works.

And such offerings are rampant all across the board, be it spreads, minimum deposits, or bonuses even. The last one is very exciting for obvious reasons and there are at least three different promotions on the platform, including the 50% deposit bonus.

When it comes to the deposit and withdrawal platforms, the broker offers one of the most comprehensive financial systems one can find. There are crypto, as well as e-wallet and traditional credit card payments available at OctaFX. And every transaction is commissionless, be it deposits or withdrawals.

Licensing

Another very important aspect of every broker review is licensing. This part determines whether a broker is legit and credible or suspicious. And for OctaFX, things are pretty straight-forward.

The broker was registered on St. Vincent & the Grenadines and received a license from Cyprus’ financial regulator – CySEC. A CySEC license means that the broker is allowed to provide service to the European citizens, which speaks highly of OctaFX.

And while the broker doesn’t extend its services to the US, Russia, and other countries’ citizens, it’s still dubious that this is because of the OctaFX scam suspicions and not for the much stricter and often ridiculous regulations in those countries.

Octafx.com review

Moving on, let’s talk about the website and software support. One of the most eye-catching things about OctaFX’s website is that it doesn’t have the most simplistic designs in the world. However, it certainly doesn’t downplay all the impressive offerings and software pieces present on the platform.

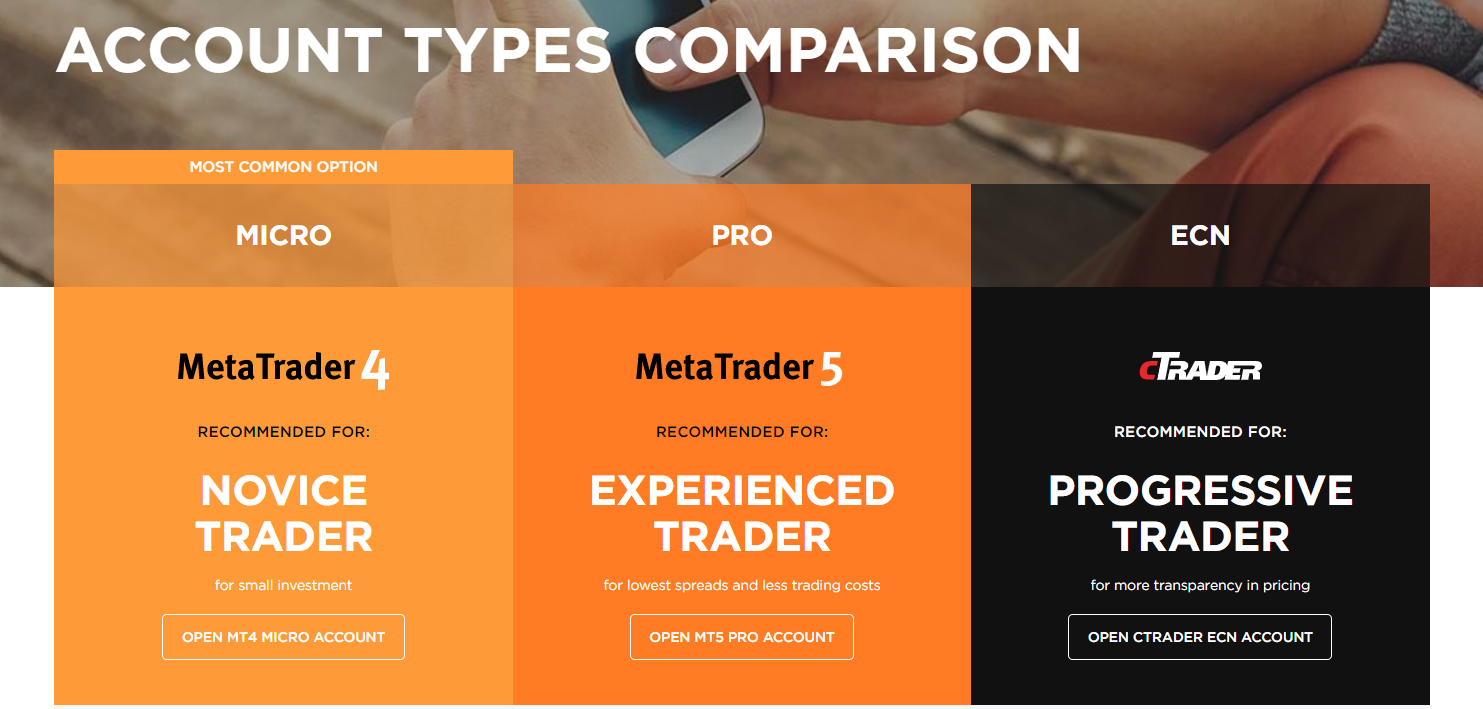

One of the biggest advantages of this broker is its diverse account coverage. OctaFX offers three different trading accounts: MT4 Micro, MT5 PRO, and cTrader ECN. All of these accounts have a pretty diverse asset base, yet their specific offerings are a completely different story.

Another impressive thing is that the broker offers both STP and ECN accounts, which we’ll be explaining further down below. Basically, these two types of accounts account for the indirect or direct connection with liquidity providers.

Finally, we have a pretty sophisticated trading software support that includes both MT4 and MT4, as well as cTrader and smartphone apps. And when it comes to customer service, the Support Department operators work 24/5 to provide help in lots of different languages.

In conclusion, a brief overview of the broker enforces our initial OctaFX opinion that we’re dealing with a credible and well-rounded Forex broker. Now, let’s discuss each of these points more thoroughly.

Impressive offerings

Let’s begin by trading terms and conditions. As we have mentioned above, OctaFX has a pretty attractive platform with lucrative offerings and promotions. All of these factors work together to make Forex trading much more profitable for people with all experience levels.

Leverage

So, the first main point is the leverage. Depending on which account type you choose from, you can potentially get a 1:500 maximum leverage for your positions. Actually, the MT4 Micro and cTrader ECN accounts offer a 1:500 leverage, while the MT5 PRO account has a 1:200 maximum leverage.

If you don’t know how leverage works, here’s a very simple example: if you want to open a trading position for $1,000, you won’t be able to yield significant profits from that position. However, if you apply that 1:500 leverage, it will increase your funds 500-times. So, now you’ll have $50,000 for your trading position, which will yield much larger profits than before.

Spreads

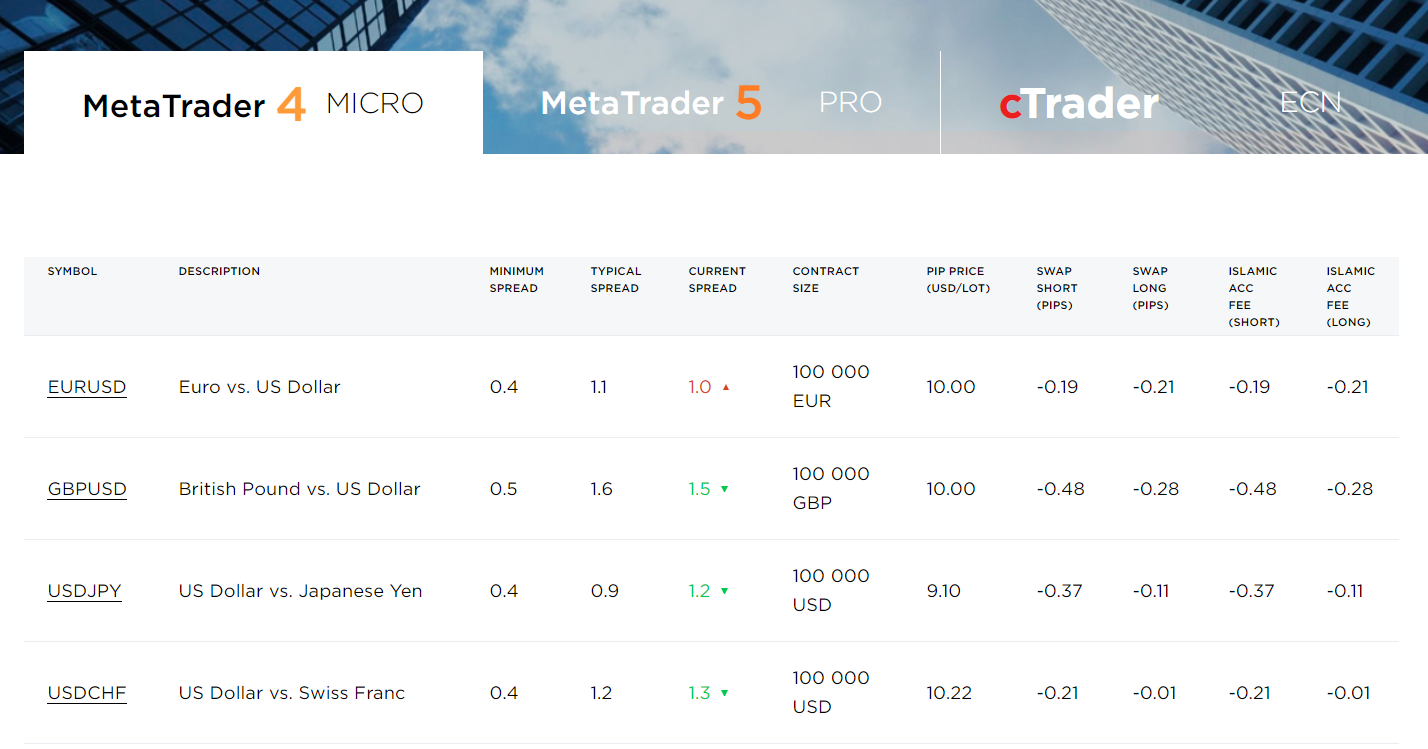

The next important factor is spreads. Spread is basically a difference between buying and selling prices of a currency pair and different brokers have different spreads. OctaFX has a minimum spread of 0.3 pips on its cTrader ECN account, while other accounts offer 0.5 or 0.9 pips for the major currency pairs.

Such a low amount of spread means that a trader takes a small portion of trading funds from its clients, while leaving the majority of it to them for future executions.

Minimum deposit

Next up, minimum deposit requirements. Usually, when traders open new trading accounts, their brokers demand a certain amount of deposit in advance. And many Forex brokers are ruthless in this sense, demanding thousands of dollars from their clients.

However, the OctaFX FX brokerage doesn’t act the same way. Instead of that, it only requires 100 USD for MT4 Micro and cTrader ECN accounts, while MT5 PRO account requires a 500 USD initial deposit. This way, many beginner traders can enter the foreign exchange market without too hefty financial commitments.

OctaFX promotions

Then there are various promotions and bonuses aimed at improving the trading experience at OctaFX. There are at least three different promotions on the platform: A Status Program, Autochartist PRO, and a 50% deposit bonus.

The last bonus, for example, implies that every time a trader makes a deposit on their account, they will get a totally withdrawable 50% bonus on top of the existing one. So, if you deposit $100, you’ll actually get $150 on the account.

Deposits and withdrawals

And last, but not least, there are deposit and withdrawal platforms. We have mentioned that OctaFX withdrawals, as well as deposits, are driven by traditional, as well as alternative payment platforms. So, here are some of the honorable mentions:

- Credit cards

- E-wallets (Neteller, Skrill)

- Cryptocurrencies (Bitcoin).

Each of those platforms has its own advantages. For instance, e-wallet deposits are instant, while Bitcoin transactions take a maximum of 30 minutes. On the other hand, Bitcoin payments are much more secure and anonymous than those made from e-wallets. On top of that, all those platforms are commissionless.

CySEC license

When traders look for Forex brokers, one of the most important aspects they examine is licensing. A license can say a lot of things about its recipient: if it’s coming from a distant and not-very-powerful financial institution like SVGFSA, there’s a big chance that the broker is a scammer because there are not many restraints to its financial activities.

On the other hand, if you’re seeing a license from, say, CySEC (Cyprus), FCA (UK), or ASIC (Australia), then you might be knocking at the right door. As you already know, OctaFX has a CySEC license provided by Cyprus Securities and Exchange Commission.

Now, Cyprus is a member of the EU, meaning it abides by strict financial rules and norms. This also means that various promotions or offerings, whether it’s the OctaFX bonus, leverage, or withdrawal, need to be compliant to other EU members’ financial rules too.

And this is certainly true because the broker does operate on the European markets. Therefore, one can easily say the CySEC license is as credible as it can get.

The website and OctaFX MT4/5 support

Design

Finally, let’s talk about website design and software toolkit. As we’ve already established, the octafx.com isn’t as simplistic as other brokers’ websites are. On the contrary, it is filled with sophisticated VFX and transition effects, as well as complex images.

However, while such a tone may be somewhat misleading to some traders, it’s still pretty easy to navigate on this website. Thematic sections are separated in a logical and straightforward manner, having FX Trading, Trading Platforms, and other tabs neatly positioned at the top of the website.

Not only that, the interface is responsive to the resolution changes. This means that if you go from a full-screen window to a smaller one, the interface will readjust itself, shrinking the tabs into a menu bar, while other details become more compact.

Accounts

Now, let’s talk about accounts. Since there are many traders who don’t have extensive experience in Forex trading, it is essential to have a specific account which is basically ideal for those traders. And OctaFX addresses that issue by offering three different account types – MT4 Micro, MT5 PRO, and cTrader ECN.

All three of those accounts are similar in a way that they offer 28 different currency pairs, 3 cryptocurrencies, and gold and silver. On top of that, the minimum position size for all three accounts is 0.1 lot (10,000 currency units), which may seem large but when applied the leverage, it suddenly becomes much more manageable. However, there are many differences between them that make them appealing to various users.

For instance, the OctaFX MT4 Micro account has a maximum leverage of 1:500, while the minimum spreads of 0.9 pips. This account is ideal for slightly less-experienced traders because they can open an account for a deposit of $100. The same would be true for the cTrader ECN account, which has the same leverage and minimum deposit requirement, but it’s far more complicated and here’s why:

ECN trading means direct communication between traders and liquidity providers (companies that provide assets). Instead of brokers mediating between the parties, traders negotiate directly with the providers, which is far more difficult and complex. However, this tool is very useful for experienced traders because it offers much tighter spreads and supports larger positions.

Trading software

Lastly, OctaFX has a pretty complex trading software support on its platform. As the account names imply, there are MetaTrader 4, 5, cTrader, and smartphone trading apps available on the website. Traders can use any software they’re comfortable with, with the only difference that cTrader is only available for ECN accounts and as mentioned earlier, ECN is quite complicated and requires a lot of experience in Forex trading.

And if anything is either blurry or problematic, traders can always contact the support center on OctaFX and get the help they need. Since Forex markets only work five days a week, the support center also works 24/5, ready to provide help in any way it can.

Final OctaFX rating

So, what’s the bottom line of this in-depth review of OctaFX? Well, one thing that we can say is that all the OctaFX fraud fears and suspicions are more of a fantasy department than that of non-fiction. All the indicators and elements we reviewed in this article suggest that the broker is quite credible.

Trading terms and conditions are very exciting, spanning from 1:500 leverage, spread of 0.3 pips, and 100 USD minimum deposit requirements. On top of that, there are various bonus promotions that make trading even more interesting and fun.

As for the license, we are pretty sure that the CySEC license is as legit and credible as it gets. And because the broker also operates in Europe, there’s no doubt that it has pretty high financial standards of its own.

And when it comes to the website and software support, the broker doesn’t fail to impress us. While the website isn’t necessarily the simplest one on the market, it’s still quite manageable and easy-to-use. The accounts are well-rounded, addressing the needs of all potential traders.

For those and other impressive conditions, we think that OctaFX is a credible brokerage that deserves the trust of Forex traders!

Comments (0 comment(s))